GENIUS Act and Its Implications

HashKey Capital

Reading Time: 4.86Min

HashKey Capital

Reading Time: 4.86Min

Today (June 17th, U.S. local time) marked a significant progress in U.S. history as the Senate passed the GENIUS Act, a bill which would establish a clear regulatory federal framework for dollar-backed cryptocurrencies known as stablecoins. Moving forward, the bill would progress to the House and President Donald Trump for approval before materializing into full effect.

Key Provisions of the GENIUS Act

At its core, the Act proposes a federal framework for dollar-backed stablecoin issuance. Some of the bill’s essential provisions include:

1:1 Asset Backing: Every stablecoin must be fully backed by high-quality, liquid reserves (such as U.S. currency, insured bank deposits, short-term U.S. Treasury bills, and similar safe instruments). Issuers must hold at least one dollar of approved reserves for every stablecoin issued. Monthly reserves and audit is required for issuers with more than $50B in circulating supply.

Tailored Regulation for Large vs. Small Issuers: The GENIUS Act takes a tiered approach based on an issuer’s scale. Large stablecoin issuers (those with over $10 billion in stablecoins outstanding) would fall under federal supervision, while smaller issuers will have the option to be under the oversight of state regulators.

Ban on Algorithmic Stablecoins: The law draws a hard line against so-called algorithmic stablecoins — tokens that attempt to hold value through programming or internal crypto assets rather than hard collateral.

No Yield: The payment stablecoins must not pay interest, dividends, or any yield to their holders. Offering yield could blur the lines between stablecoins and savings products, raising regulatory and financial stability concerns.

Not Securities or Commodities: the GENIUS Act amends existing securities laws to clarify that a compliant payment stablecoin is not a security or commodity. This carve-out resolves a major uncertainty of the security regulations. Instead, stablecoin issuers will be under the regulatory oversight of the Office of the Comptroller of the Currency (OCC), Federal Reserve, FDIC, NCUA, and state regulators.

Insolvency protection: Stablecoin holders have priority claims over other creditors during bankruptcy events.

Why does this matter?

Stablecoins are not just crypto-native assets — they are the foundational layer for a growing share of global financial activity. Currently, stablecoin commands a market capitalization of more than $250B dominated by Tether and Circle. Circle, which recently got listed on the NYSE is now valued at $37B and have seen their stock value surged more than 400% since listing, underscoring market optimism around the mainstream adoption of stablecoins and how regulatory clarity will benefit stablecoin issuers like Circle.

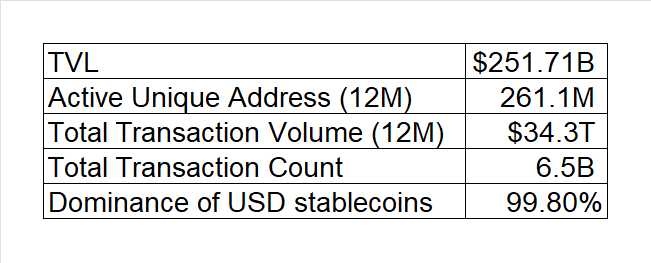

Stablecoins are becoming deeply interconnected in the payment landscape today. On an annual basis, stablecoins facilitated more than $30T in transaction volume with more than 261M in annual active stablecoin addresses.

Stablecoin Performance Metrics

A recent survey by Coinbase found that 81% of crypto-aware SMBs are interested in using stablecoins, while the number of Fortune 500 companies planning to adopt or explore stablecoins has more than tripled compared to 2024.

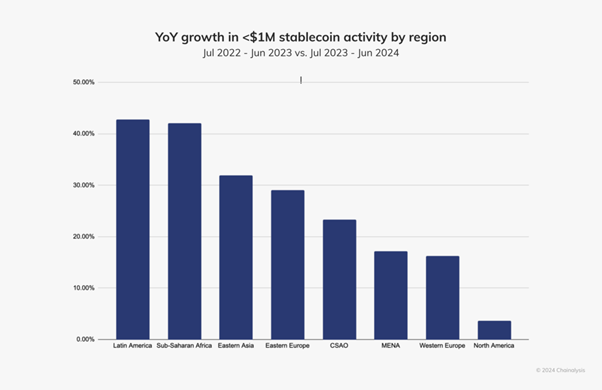

Elsewhere, stablecoin adoption is also accelerating especially in emerging markets where currency volatility is high. According to Chainalysis 2024 Stablecoin Report, Latin America and Sub-Saharan Africa are leading in terms of retail and professional-sized stablecoin transfers with the regions experiencing YoY growth exceeding 40%. Eastern Asia and Eastern Europe follow closely, with 32% and 29% YoY growth respectively.

While jurisdictions like the EU (via MiCA), Singapore (via Payment Service Act), and Hong Kong (via Stablecoin Bill) have advanced regulatory clarity around stablecoin issuance, the U.S. is held back by political uncertainties.

The passage of the GENIUS Act in the Senate could change that.

Implications for investors, startups, and the ecosystem

Regulated stablecoins: U.S. stablecoin issuers like Circle and Paxos could benefit from regulatory legitimacy, paving the way for institutional inflows into compliant stablecoins for onchain payments. Additionally, the requirements for stablecoins to be backed by cash or U.S. treasuries could further cement the position of these players as smaller unregulated players offering non-fiat backed, yield-bearing stablecoins exit the market. But due to the “No Yield” requirement, Circle may also have to change its current GTM strategy which pays revenue to Coinbase as a very important USDC distribution channel.

Offshore Stablecoins: The era of arbitrary or unclear regulation for offshore stablecoins is coming to an end. The GENIUS Act tilts the playing field against unregulated foreign stablecoin issuers with hefty penalties. Tether (USDT), the largest stablecoin, could face severe challenges under the new regulation, potentially facing the same trajectory as it did in Europe if Tether does not register with the Office of the Comptroller of the Currency. However, the moat of USDT is strong enough which other stablecoins cannot compete against overnight, and Tether may find some other way, such as launching a new regulated token in the US to gain the market.

Fintech space: This Act is a broader signal that crypto legislation is advancing beyond enforcement headlines toward structured policy. With stablecoins inching closer to becoming a legally accepted financial token, this will drive more retail adoption while also stimulating greater investment activity in the space. Stripe, being a notable example, has strengthened its position in the stablecoin ecosystem through strategic acquisitions, including the $1.1 billion purchase of Bridge in February and the recent acquisition of Privy, a wallet infrastructure provider. And large tech companies like Meta are not forbidden from issuing stablecoins, but they could face high regulation requirements and explicit watches, leaving this sector with more uncertainties which could favor startups.

What’s next?

House Action and Potential Changes: Although very important, Senate passage is just one step in its legislative journey. The focus now shifts to the U.S. House of Representatives. The momentum is on the stablecoin side, but we should watch for potential amendments in the House. Any change could affect the stablecoin landscape in the future.

Regulatory Implementation and Guidelines: while the GENIUS Act is a blueprint for requirements including reserving, licensing, etc. it directs regulators to issue detailed rules such as tailored capital, liquidity, and risk management rules. We need to see how regulators like the Federal Reserve, OCC, FDIC, FinCEN can convert the framework into specific rules. And how states will move under this regulation is another thing that needs to be watched.

Reference:

https://www.coinbase.com/en-sg/blog/the-state-of-crypto-the-future-of-money-is-here

https://bitcoinmagazine.com/news/u-s-senate-passes-stablecoin-bill-the-genius-act