HashKey Capital Monthly Insights Report: June 2025

HASHKEY CAPITAL

Reading Time: 17.02Min

HASHKEY CAPITAL

Reading Time: 17.02Min

Overview

June 2025 saw the financial markets navigate significant macroeconomic and geopolitical turbulence while still achieving notable milestones. Macroeconomic uncertainties was accentuated by a sudden Middle East crisis as hostilities escalated between Israel and Iran, threatening oil supply via the Strait of Hormuz. However, after 12 days of airstrikes that saw the United States also participating in the attack against Iran, Israel and Iran have agreed to a ceasefire which momentarily lifted market sentiments. The U.S. Federal Reserve held interest rates steady (4.25%–4.50%) at its June meeting, pausing its tightening cycle even as it warned of “meaningful” inflation ahead due to new import tariffs. Despite that, risk assets remained resilient. S&P 500 and Nasdaq Composite Index hit all-time highs fuelled by renewed AI enthusiasm coupled with optimism over a dovish Fed as Trump is reportedly considering a replacement of Fed Chair Jerome Powell.

Total crypto market capitalization remained largely unchanged although the slew of geopolitical conflicts have tapered investors’ risk-on appetite as they digest the impacts of the conflicts and await for the next concrete crypto market catalyst.

A landmark event in June was Circle Internet’s IPO on June 5, which attracted tremendous investors demand. Circle saw its stock skyrocket over 800% from the $31 IPO price to ~$300 by late June, marking one of the fastest surges since the 1980s. Its success can be attributed to premiums paid to crypto-exposed companies, compliance edge from the potential legislation of GENIUS Act, and lucrative revenue that Circle earns from Treasury yields.

Looking at regulatory developments globally, South Korea’s FSC unveiled a roadmap to approve spot crypto ETFs by late 2025 and develop a won-backed stablecoin system, as the country’s new administration pushes pro-crypto reforms. Meanwhile, Hong Kong accelerated its crypto hub ambitions introducing a new Policy Statement 2.0 built on its crypto policy statement in 2022 which highlighted plans to clarify licensing regimes for digital asset service providers, improve use case and cross-sector collaboration as well as drive greater RWA tokenization. Hong Kong has also approved its Stablecoin Bill which is expected to take effect from 1 August. Meanwhile, Singapore tightened its oversight: by June 30, the MAS required any Singapore-based crypto firms serving overseas customers to cease operations or obtain new licenses, part of its strict approach to mitigate AML/CFT risks while balancing innovation. Overall, June reflected a shift toward constructive regulation in major markets (U.S., South Korea, Hong Kong, Singapore) while addressing risks.

Bitcoin

Bitcoin extended its strong 2025 rally, appreciating 2.9% in June and firmly breaching the psychological $100,000 level. After a brief mid-month dip below $100K during the height of Israel-Iran tension, BTC rebounded swiftly after a ceasefire was announced and reinforced its role as a pivotal financial asset during crisis periods, ending June comfortably above $105K. Coupled with the growing institutionalization of BTC ETFs which drew $4.48B in net inflows in June, Bitcoin dominance surged to ~64–65% by month-end — the highest in over two years — as investors rotated out of riskier altcoins. The ETH/BTC price ratio plunged to ~0.023, near its lowest point since 2019, reflecting Bitcoin’s outperformance. This stagnation of ETH vs BTC has dimmed hopes for altcoin season. As of late June only ~23% of top altcoins were outperforming BTC, far below the 75% threshold for a true alt-season. In other words, the market remained in a “Bitcoin season” — a dynamic where BTC’s gains outpace the broader market — which is typical during periods of macro uncertainty and when institutions remain heavily invested in Bitcoin.

From an onchain perspective, activity has slowed down significantly painting a starkly different image from offchain metrics. Bitcoin’s monthly transactions hit 10.3M, the lowest since October 2023, suggesting that a significant share of market participation has shifted to off‑chain instruments such as passive Bitcoin ETFs and that trading activity is now increasingly dominated by institutional players. As a result, acceleration fees earned by Bitcoin miners declined substantially in June. Total transaction fees earned by the network also slid by 25.25% MoM.

Onchain data from Glassnode showed continued accumulation among long term holders with long term supply held and long term supply/short term supply ratio reaching their highest levels, underscoring enduring conviction for further growth in Bitcoin.

Lightning Network usage has declined in June with metrics such as nodes, channels and channel capacity declining across the board. Although overall usage has slowed, innovation remains strong, with multiple projects continuing to launch new features and integrations. Lightning Labs announced Taproot assets v0.6 which introduces a more seamless developer experience, robust testnet environment, enhanced RFQ for time-limited price quotes, and allowing payment receivers to combine multiple payment channels and receive larger payments. Breez Technology has also announced their first cohort of applications spanning wallets, remittance services to food delivery that are now leveraging the Breez SDK to enable Lightning payments for their users. Merchant adoption continues to increase with more than 16,600 locations now accepting Bitcoin payments.

Ethereum and L2s

Ethereum declined 3.5% in June, and although it initially rallied past $2,800, earlier gains were quickly erased on the back of heightened geopolitical tensions as investors await for more concrete catalysts. Overall, Ethereum continues to attract new users and liquidity although sentiment remains cautious as capital deployment stayed conservative.

Daily active addresses and the 30DMA of new users have both increased by 7.93% and 14.4% MoM. Despite that, the increased adoption did not materially transpire into higher speculative activity. Monthly transactions declined by 3.57% MoM, with DEX trading volume seeing a sharper drop of 18.12% MoM. Trading bots which tend to do well in risk-on sentiment underperformed in June as risk appetite noticeably subsided. Incumbent trading bot, Banana Gun, saw its monthly trading volume fall 3.57% MoM and fees generated declined 30.4%. Beyond speculative trading, DeFi TVL increased from $60.8B to $62.4B which can be attributed to increased capital deployment into liquid staking, RWA and lending sectors. Staked ETH recently clocked a new all-time high, reaching 29.2% in June. Liquid staking protocols have also increased by 2.65% MoM to achieve a $34.9B TVL. TVL on Aave grew by 3.86% MoM alongside 8.8% growth in new users. Despite Base cementing itself as the dominant chain for AAVE, daily new users on Aave Ethereum have exceeded Base on 2 occasions in June. Aave’s growth on Ethereum continues to highlight the deep liquidity, widest asset selections that are pivotal in expanding its user base in a low cost environment. Morpho also saw a notable MoM increase of ~8% in TVL boosted by its recent launch of Morpho V2 which introduced more flexible loan arrangements and regulatory compliance. Maple Finance similarly witnessed significant growth in TVL, growing by 29.80% MoM to $2.57B driven by its attractive APY across various lending pools with high yield vaults offering 9.9% APY, Blue Chip vaults with 7.1% APY, and Bitcoin Yield vault with 4–6% APY. These yields far outperformed other blue chip assets with large liquidity, positioning Maple as an attractive destination for yield farmers.

Since the Pectra Upgrade introduced EIP‑7702 (“smart accounts”), adoption has risen sharply. Leading providers — most notably MetaMask and Uniswap’s smart wallets — now handle the majority of authorization transactions on four major dApps: Uniswap, LiFi, Euler Finance, and Across Protocol. Although currently only 0.5% of retail wallets have authorizations, the spike in EIP-7702 authorizations in June highlighted steady buy-in from wallets and protocols and we expect this trend to continue.

Ethereum ETFs also saw healthy demand in June, more than doubling its net inflows from May to $1.16B, illustrating that institutions are expanding capital allocation to Ethereum amid increasing regulatory clarity which is expected to drive more adoption of the largest smart contract platform.

Within Ethereum’s tech ecosystem, June saw continued innovation, especially around Uniswap v4 and “hooks.” On June 10, the Uniswap Foundation launched the Hook Design Lab, an initiative to foster custom smart contract hooks that extend Uniswap v4’s AMM functionality (enabling features like dynamic fees, on-chain limit orders, auto-rebalancing, etc). This has led to an explosion of new DeFi designs: by the end of June, over 1,000 Uniswap v4 hook contracts had been initialized. One early standout is EulerSwap, a DEX that is compatible with Uniswap v4 hooks and built on top of Euler lending vaults — it has driven significant volume growth as one of the hook-enabled pools live so far, allowing liquidity providers to earn from lending yields, while also earning from swap fees. We expect more “hooked pools” to launch in coming months, potentially reinvigorating DeFi activity on Ethereum L1.

Post Pectra Upgrade which introduced more blobs per block, fees on L2s have significantly declined. This resulted in stronger user growth seen in L2s as the number of monthly active L2/L1 users increased from 6.4 to 6.5 in June. Similarly, usage has increased on L2s with monthly transactions of L2/L1 increasing from 15.8x to 16x. Among L2s, Base, Arbitrum, Unichain and Worldchain recorded healthy growth metrics. Below, we will also mention notable developments from these chains.

Arbitrum

Arbitrum saw a 37.7% increase in daily active addresses in June driven by growth in stablecoin adoption. Peer-to-peer monthly stablecoin transaction count and monthly active stablecoin addresses grew by more than 52.3% and 2% MoM respectively. Active returning addresses also gained 48.86% MoM, underscoring Arbitrum’s competitive edge in user cohort retention among leading L2s. Perpetuals trading picked up momentum, most notably reflected by GMX, which posted gains in both trading volume (+4.79% MoM) and total value locked (+17.55% MoM) to achieve $6.13B and $458.66M respectively.

Other notable announcements and upgrades announced in June:

Partnered with Robinhood to power their new L2 chain which will eventually be used to bring equity onchain. Currently, Robinhood has launched tokenized equity on Arbitrum for eligible users in the EU.

Arbitrum has completed the rollout of ArbOS 40 Callisto for Arbitrum One and Arbitrum Nova. This upgrade implemented execution layer changes during Ethereum Pectra Upgrade.

FDUSD went live.

Base

In June, the Base network’s daily active addresses increased 13.3% month over month, underpinning concurrent expansions in stablecoin suuply and DeFi TVL. Stablecoin supply and monthly transactions have gained 1% and 24.5% in June, underscoring the network’s increasingly important role in facilitating payments. Monthly stablecoin transfer volume of $1.3T is more than 20x the next leading chain, Arbitrum. This can partly be attributed to Base’s expanding ecosystem with large corporate partners like Shopify and Stripe now allowing USDC payments on Base. DeFi’s TVL rose on the back of lending protocols growth — exemplified by Morpho’s 25.11% growth — while softer speculative activity on venues such as Uniswap and Virtuals Protocol dampened trading volumes and fee income.

Other notable announcements and features include:

Introduced wrapped ADA, LTC, DOGE and XRP.

Integrated Base DEX within Coinbase, providing its large user base with CEX and DEX experience.

Unichain

Unichain recorded a 25.56% decline in its daily active users in June although monthly transaction count grew 35.55% alongside a 41.38% MoM increase in DeFi TVL. Despite total DEX volumes declining 16.28% MoM, DeFi TVL witnessed notable growth led by Euler, Uniswap and Morpho. Liquidity incentives has been primarily driving activity on Euler, which has given out rEUL worth more than $300K on Unichain with plans to continuing the incentive program. Uniswap also announced its first cohort for Hook Design Lab which aims to drive adoption of its v4 Hooks feature. EulerSwap, which is part of the first cohort, contributed significantly to the trading volumes on Unichain and saw a 179% MoM growth in TVL. The upcoming Uniswap Conditional Funding Markets offer $900K in incentives for lending protocols which could spur further activity and traction moving forward.

Other notable announcements and features include:

1inch integrated with Unichain.

Morpho achieved $113M in TVL deposits on Unichain.

Euler Finance witnessed significant growth in June with more than $200M in deposits.

Announced Unichain Build Week, a DeFi accelerator program.

Worldchain

Worldchain saw increased adoption and usage in June, growing for the third consecutive month. World ID, its anonymous identity solution, has also achieved more than 100M+ in 3rd party app uses. Verified users on World will now gain priority in their transactions over bots, marking a step towards fairer, verified network usage. DeFi activity also grew in June led by Uniswap and Morpho recording 7.23% and 11.33% MoM increase in TVL. Uniswap generated $31.13M in trading volume in June, up from just $232.18K.

Other notable announcements and features include:

Native USDC is now supported and reached $31.5M in total supply.

Bitgo announced the integration of Worldchain.

Introduced World Vote Mini App: 1 ID to 1 vote, stored immutably onchain.

Introduced Deep Face Mini App: helps to detect deepfake from real users.

Other L1s

Beyond Ethereum and L2s, several alternative L1 blockchains had noteworthy developments in June.

BNB Chain

BNB Chain quietly gained ground as funds and users flowed in from struggling networks. In June, BNB Chain saw net positive inflows of $16.4M — particularly from Ethereum and Solana. One clear indicator is stablecoin distribution: BNB Chain’s stablecoin float grew significantly while Solana’s shrank. By month’s end, BNB Chain overtook Solana as the #3 largest chain for stablecoin supply (behind Ethereum and Tron). Stablecoin circulating supply on BNB Chain rose by +$0.26B (with notable USDT and FDUSD inflows), whereas Solana’s stablecoin supply fell by roughly –$0.93B. Correspondingly, the number of stablecoin active addresses on BNB Chain increased by 12.38% more than doubling the growth on Solana. DEX volume on BNB surpassed that of Solana for the second consecutive month, more than doubling in volume, highlighting the growing stablecoin and DeFi activity on BNB. Fundamentally, BNB offers ultra-low fees and a familiar EVM environment, making it a beneficiary whenever Ethereum fees spike or other chains wobble. Its strategy of fast-following Ethereum’s tech while leveraging Binance’s user base is keeping it a top chain by usage. BNB’s growing adoption sees interest not only from retail but also institutions. For example, Nano Labs have announced plans for a $500M BNB treasury supported by the issuance of its convertible notes.

Solana

Solana faced headwinds in June as its price dipped slightly in June. Although DeFi TVL slightly increased to $8.64B, network participation has declined with daily active users, monthly transactions decreasing. Speculative trading activity has declined substantially by 36.19% MoM after the Q1 meme-coin boom: for example, Raydium DEX volume is down ~80% from its January peak. Nonetheless, the Solana community and investors are doubling down on the network’s long-term potential as a high-performance DeFi and RWA chain. In a significant validation, crypto exchange Bybit announced “Byreal,” a new hybrid DEX built on Solana, with a testnet launched on June 30 and mainnet expected in Q3. Backed Finance, an issuer of tokenized equity has also launched xStocks tokenization platform, bringing selected US stocks and ETFs to Solana. To strengthen its position as a leading hub for tokenized equities and broaden its ecosystem, the Solana Foundation has signed multiple memoranda of understanding (MoUs) with major exchanges to evaluate dual‑listing mechanisms, and is working alongside regulators on initiatives to promote a Solana Economic Zone in Dubai.

Aptos

The Move-based blockchain gained a slight 3.38% in price during June although underlying metrics reflected a faster pace of growth. DEX activity has visibly taken off on Aptos with Hyperion DEX now the leading DEX on Aptos, generating $3.3B in monthly trading volume and recording ~75% gain in TVL to $126M. This has largely contributed to an increase in fees generated for the network.

Other notable announcements and features include:

Aptos Labs announced Shelby, a decentralized hot storage solution developed with Jump Crypto. Shelby allows monetizable reads, low latency and high throughput access to data on the network.

Baby Raptr Upgrade went live on Aptos, reducing consensus latency during high network load.

Introduced Confidential Transactions on Aptos Devnet, aimed at supporting institutions that are seeking privacy and compliance on the blockchain.

In summary, the non-Ethereum L1 space is consolidating: leaders like BNB Chain, Solana and Aptos are rapidly expanding their ecosystem through institutional partnerships and project development.

Stablecoins

Stablecoin market overview

Stablecoins continued to anchor crypto liquidity in June: total supply rose 2.52 % to $253.66B, mirroring investors’ pivot to lower‑volatility assets. USDT dominated with ≈ US $158.52B outstanding — increasing its market share to about 67 % of total supply. The passage of the GENIUS Act in the Senate does not seem to negatively impact Tether, but instead led to a greater boost in capital inflows than Circle which suggests that many traders preferred the deeper liquidity of USDT when positioning for the GENIUS Act’s rollout which might not negatively impact Tether, if it adheres to regulatory compliance within the given timeframe.

Issuer‑level dynamics: Tether vs Circle

USDT pulled in $4.86B of fresh deposits in June, nearly five times more than any rival. By contrast, USDC only attracted $0.78B, keeping its market share roughly flat. However, in terms of monthly active addresses, USDC saw an increase in transacting users in June while USDT users declined, underscoring retail shift towards stablecoin that is regulatory compliant from day one.

Chain‑level flows and regulatory tailwinds

Stablecoin activity shifted among base layers: Ethereum, Tron and BNB and Arbitrum all logged absolute supply gains, while Solana saw net outflows large enough to cede its third‑place ranking to BNB. Growing legal clarity globally — from Hong Kong’s stablecoin bill to potentially approved U.S. GENIUS Act — underpinned on‑chain volume growth and a flurry of corporate integrations:

Coinbase, Stripe & Shopify began offering USDC checkout for merchants in 34 countries.

Mastercard joined Fiserv to let merchants accept stablecoins irrespective of payment rail.

Visa teamed with Yellow Card to broaden stablecoin payouts across CEMEA region.

China’s JD.com disclosed plans to seek global stablecoin licences to settle cross‑border sales.

South Korea’s KB Kookmin Bank filed 17 patents covering stablecoin issuance and infrastructure.

The Philippines’ Coins.ph launched a regulated peso‑backed token aimed at the US$40 billion remittance market.

AUDD, issued by AUDC Pty Ltd, debuted on Hedera on 18 June — the first commercial AUD‑pegged stablecoin.

Ripple unveiled five fiat‑backed tokens (RLUSD, XSGD, EUROP, USDB, USDC) on the XRP Ledger.

Franklin Templeton now accepts stablecoins for purchasing its tokenised securities.

These developments signal that regulatory progress and large‑scale commercial integrations — not just crypto‑native demand — are steering the next leg of stablecoin adoption.

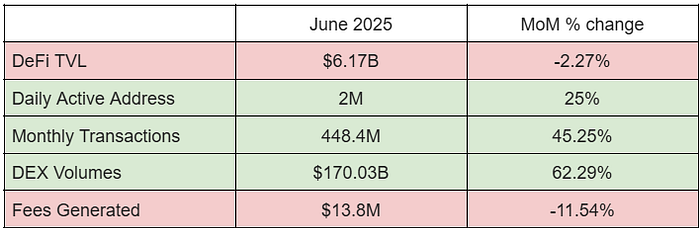

Stablecoins Performance Metrics

Thematic Highlight: Tokenized Equity

After earlier success with tokenized private credit and treasury, the market has shifted its attention to equity in June. Public equity market, worth more than $125T in 2024, represents a massive opportunity for tokenized equities especially as the traditional financial market still grapples with legacy infrastructures. Leveraging on blockchain’s programmability and speed, tokenized equities seek to provide a more seamless trading experience and unlock greater capital efficiency for users. As of today, tokenised equity has reached a market value of US $386.8 million, marking a 28.51 % increase year‑to‑date. June was particularly strong: monthly active addresses surged by over 4,660 %, and transfer volume expanded by more than 120 %. Driving the growth and interest has been greater institutional, ecosystem expansion, and regulatory clarity. Some notable developments include:

Hong Kong Government released Policy Statement 2.0 which aims to promote tokenization of a broad range of assets and financial instruments, positioning Hong Kong as a leading hub for digital innovation.

Bybit and Kraken announced support for tokenized equity through Backed Finance’s xStocks.

Dinari Securities received a broker/dealer license with the SEC and FINRA to offer tokenized stocks.

Coinbase is seeking approval from the SEC to offer blockchain-based equity.

Robinhood launched more than 200 tokenized equity and ETFs on Arbitrum blockchain to users in Europe.

Leading Solana treasury firm and publicly-listed consumer brand holding company, Upexi, plans to tokenize its shares via Superstate’s Opening Bell tokenization platform.

While interests appear to be overheated for now, we think this will not be a passing fad but a phased rollout, although there are several key challenges and consensus to be addressed. Private equity often has strict transfer restrictions and requires the explicit approval from company boards hence company buy-ins remain as a significant hurdle. Issuing tokenized versions of custodied shares also means that protocols are subjected to the settlement times in traditional markets with added risks of smart contracts vulnerabilities and overleverage. A concerted effort between regulators and industry participants are required to establish a standardized framework with a key focus on risk management, streamlined approach to corporate actions and consumer protection. For more insights on the state of tokenized equity and key players driving the landscape, check out our latest report.

That concludes this month’s update — stay tuned for the next one! :D