Reframing Ethereum’s Technical Roadmap Through the Lens of Treasury Strategy

HASHKEY CAPITAL

Reading Time: 7.36Min

HASHKEY CAPITAL

Reading Time: 7.36Min

On July 30, 2025, Ethereum celebrated its 10th anniversary. From its original vision as a “World Computer” to its evolving role as a settlement layer for assets, data, and applications, Ethereum is undergoing a profound and subtle transformation. As interest from traditional financial institutions accelerates and technical upgrades move forward, Ethereum is developing a dual-engine ecosystem driven by both technology and finance. At the same time, Ethereum’s core development teams appear to be re-centering their technical focus on Layer 1.

This report takes a relatively underexplored angle, Ethereum as a treasury asset, to reassess the network’s evolution and technical strategy. With more institutions (ETFs, public companies) beginning to accumulate and hold ETH, can this trend align with Ethereum’s protocol development and spark new synergies? By analyzing the deeper motivations behind Ethereum’s roadmap and introducing upcoming technical changes, this report aims to provide insight into how Ethereum’s future trajectory may be shaped by treasury-driven considerations.

1. “World Ledger” and Institutional Reserves

Ethereum is undergoing a deep identity transformation. It was once the playground for developers experimenting with decentralized applications: Web3’s “operating system.” Today, however, it is increasingly regarded as a global value ledger. This shift is evident not just in community discourse but in the evolving narrative and the asset type of ETH.

Narrative Shift: World Computer → World Ledger

One of the most notable changes in Ethereum this year is its narrative. On June 20, Vitalik Buterin retweeted ConsenSys founder Joseph Lubin, explicitly affirming that “Ethereum L1 is the World Ledger.”

This marks a sharp departure from the previous “World Computer” vision, where Ethereum served as a platform for complex on-chain logic (e.g., DeFi contracts). In contrast, the “World Ledger” framing emphasizes Ethereum as a global settlement layer for value, especially for assets like stablecoins and real-world assets (RWA).

Notably, both Vitalik and Lubin specified “Ethereum L1,” indicating a renewed focus on the base layer rather than the ecosystem at large.

Asset Shift: Institutional ETH Treasury Accumulation

In tandem with this narrative shift, institutional actors have begun acquiring ETH as a treasury reserve. According to Bitwise CIO Matt Hougan, from mid-May 2025 onwards, Ethereum-based exchange-traded products (ETPs/ETFs) and corporate treasuries have purchased approximately 2.83 million ETH, compared to just 89,000 ETH newly issued in the same period, a demand-to-supply ratio of 32:1. This imbalance is believed to be a key factor in ETH’s recent price appreciation.

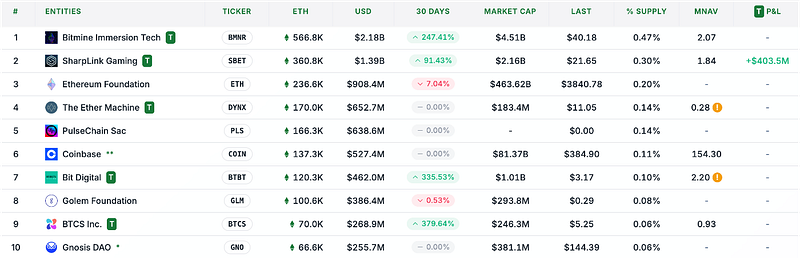

As per the Strategic ETH Reserve tracker, several institutions now hold more ETH than even the Ethereum Foundation. For example, U.S. public company BitMine Immersion Technologies (founded by Tom Lee) holds around 566,800 ETH, and SharpLink Gaming (associated with Joseph Lubin) holds about 360,800 ETH.

2. ETH vs BTC: Distinct Treasury Models

Institutional ETH accumulation invites comparisons with Strategy’s sustained Bitcoin purchases. However, Ethereum’s monetary design differs substantially from Bitcoin’s.

Bitcoin has a fixed supply cap and a predictable issuance schedule (halving every 4 years). Holding a certain amount of BTC effectively secures a fixed percentage of the total monetary base.

In contrast, Ethereum’s issuance changed dramatically after the 2021 London upgrade and EIP-1559. Now, a portion of ETH transaction fees (base Fee) is burned. When on-chain activity is high, the burn rate can lead to net deflation. When activity is low, ETH issuance results in net inflation. Thus, ETH supply is tightly linked to network usage.

This makes Ethereum less “buy-and-hold” friendly as a treasury asset: without sufficient L1 activity, ETH becomes inflationary, diminishing its scarcity. This effect intensified after the 2024 Dencun upgrade, which slashed L1 gas fees and dramatically reduced ETH burn, leading to Ethereum’s first sustained inflation trend since The Merge.

According to data from ultrasound.money, Ethereum currently experiences a net issuance of around 70,000 ETH per month — roughly one-third of the Ethereum Foundation’s holdings. This means even large institutional buyers face challenges maintaining a significant impact.

In contrast, Bitcoin’s issuance schedule is unaffected by network activity. As a result, Ethereum’s value accrual is more usage-dependent: only when there is sufficient on-chain activity and fee burn can ETH maintain its “ultrasound money” status.

3. Shifting Ethereum’s Technical Roadmap

Given the tight linkage between ETH’s economic model and network usage, boosting mainnet activity has become essential to maintaining ETH’s value.

For years, Ethereum has followed a “Rollup-Centric” roadmap: keep L1 lean and secure, offload scaling to Layer 2. Vitalik has repeatedly articulated this vision, emphasizing rollups as the primary medium-term scalability solution. This strategy made sense when L1 gas fees were high, and TPS was limited.

However, Rollup-Centrism has a side effect: L2s siphon transactions away from L1, dampening fee burn. Combined with EIP-1559, this leads to declining ETH consumption on the base layer.

Since April 2025, Ethereum Foundation co-executive Tomasz Stańczak has signaled a strategic pivot: renewed attention to L1 scalability and user experience. The goal: increase L1 capacity and attract more on-chain activity to reassert Ethereum’s role as a global ledger while restoring ETH’s deflationary dynamics.

4. Key Technical Measures Supporting This Shift

Ethereum is already implementing several upgrades to strengthen L1 throughput and value capture:

Gas Limit Increases: In 2025, Ethereum raised the per-block gas limit multiple times — from 30M to 36M and then to 45M. This increases block capacity, boosting L1 TPS from ~15 to nearly 18.

L1-Based Rollup Sequencing: Projects like Based Rollups assign L2 sequencing to Ethereum L1 validators rather than centralized operators. This enhances censorship resistance and enables cross-rollup composability. Taiko and Surge Rollup are early adopters.

L1 zkEVM with Real-Time Validity Proofs: Ethereum developers are exploring zkEVM integration directly at L1. This would let validators confirm block correctness using zero-knowledge proofs, skipping full transaction execution and improving efficiency. Projects like Succinct and Boundless are working to enable this.

Fusaka & Glasterdam Hard Forks: Two major network upgrades, Fusaka (expected November 2025) and Glasterdam (tentatively 2026), will implement key proposals discussed below.

RISC-V Execution Layer (Long-term): Vitalik proposed switching Ethereum’s execution architecture to the RISC-V instruction set to improve performance and fairness. Though a long-term effort, this could yield up to 100x execution speed improvements.

5. Highlights in Fusaka & Glasterdam

The next two major upgrades, Fusaka and Glasterdam, aim to boost both L2 support and L1 scalability.

Fusaka Upgrade (Q4 2025)

Fusaka builds on Pectra but focuses more on data availability and future performance enhancements than user-facing features.

EIP-7594: PeerDAS Allows validators to sample only small data chunks (blobs) instead of downloading full data, enhancing scalability and supporting L2s.

EIP-7987 (from EIP-7825) Sets a per-transaction gas cap of 16,777,216 (²²⁴) to prevent single transactions from monopolizing entire blocks. This enables future block-level parallelism and execution optimizations.

Glasterdam Upgrade

Focuses squarely on L1 scaling and consensus improvements.

EIP-7928: Block-Level Access Lists (BAL) Provides clients with read/write sets in advance to enable deterministic multi-threaded execution. This reduces worst-case latency and improves predictability and scalability.

EIP-7732: ePBS (Execution-Proposer Separation) Decouples execution from consensus, enabling higher block throughput without harming stability. Potential for 3–4x gas increases per block. Still under active debate, particularly around MEV implications.

EIP-7782: Shorter Block Times Proposes reducing block times to 6 seconds. This would double block frequency, reduce confirmation latency, and distribute proposer rights more widely. It requires coordination with execution and network layers.

Together, these proposals aim to significantly improve Ethereum’s L1 throughput while preserving decentralization and security.

6. Conclusion and Outlook

From the above analysis, it’s clear that Ethereum is undergoing a comprehensive transformation, from its narrative to its technical roadmap, shifting from a “World Computer” to a “World Ledger.” This shift is driven by two key forces: externally, the macro environment, as more institutions and traditional enterprises begin adding ETH to their balance sheets, necessitating a robust and high-throughput settlement layer; and internally, by the requirements of Ethereum’s economic model, which depends on sustained fee burn on the mainnet for ETH to maintain its “ultrasound money” properties.

Looking ahead, Ethereum’s upcoming upgrades over the next few years will likely revolve around a central goal: increasing on-chain activity. Whether through the adoption of zero-knowledge proofs to lower verification costs, or by optimizing the consensus mechanism to accelerate block times and expand capacity, all efforts point toward supporting more transactions and applications on-chain. On the application side, we may see emerging asset classes like real-world assets (RWA) become new engines of mainnet activity, bringing high-value transaction volume to Ethereum and solidifying its role as the global ledger.

References:

Vitalik Buterin Backs Ethereum L1 as Institutions Boost Holdings

ETH Reverts to Inflationary Asset Following Fee-Reducing Dencun Upgrade

Ethereum Foundation shifts focus to user experience, layer-1 scaling

Ethereum is scaling: TPS, gas limit up as validators back 45M target

Ethereum’s Next Upgrade ‘Fusaka’ Could Cut Layer-2 and Validator Costs

Ethereum 2030: The leaner L1 and its performance and aligned rollups

EIP-7928: Block-level Access Lists: The Case for Glamsterdam