DAT Report, Volume 1: Background and Introduction

HASHKEY CAPITAL

Reading Time: 14.62Min

HASHKEY CAPITAL

Reading Time: 14.62Min

Download the report here: DAT Report - Chinese | DAT Report - English

How DAT is Reshaping the Investment Landscape

Over the past five years, the Digital Asset Treasury (DAT) model has progressed from a niche experiment into a recognized capital market trend, embraced by firms ranging from MicroStrategy in the United States to Metaplanet in Japan, as well as dozens of other publicly listed companies worldwide. DAT companies have not only reshaped the balance sheet of their companies by incorporating digital assets such as Bitcoin and Ethereum but also provided investors with a way to differentiate themselves from their competitors. By incorporating digital assets such as Bitcoin and Ethereum into their balance sheets, DAT companies not only reshape their capital structure but also provide investors with an alternative investment opportunity that is different from ETFs and funds.

This report, as the first of our DAT series, will give a primer on DATs and analyze its strategic significance in the capital market and crypto ecosystem. Through data and case studies, we will see why more and more companies are choosing to become "coin stocks" and how this model can serve as a bridge between traditional finance and the world of digital assets.

1. What is DAT

DAT is a business model in which a publicly traded company pursues a strategy of accumulating digital assets such as Bitcoin and Ethereum as a core part of its business. It is not only an adjustment of asset allocation, but also a strategic positioning of enterprises for the future digital economy.

Digital Asset Treasury Companies (DATs) have become an important narrative in the digital asset ecosystem as institutional capital continues to flow in and actively seek digital asset allocation. These companies are typically publicly traded and have publicly announced plans to make significant long-term accumulation of digital assets part of their core business strategy.

Exemplified by the success of MicroStrategy along with favorable regulatory policies in the U.S. regulatory level, have driven the rapid growth of digital asset treasury companies. The executive order signed by President Trump officially allows for the creation of a strategic Bitcoin reserve; meanwhile, institutional investors are now able to measure digital asset positions at fair value, enabling digital asset strategies to be recognized and validated on corporate balance sheets. Driven by these favorable factors, market demand for digital asset treasury has followed quickly. In terms of regional distribution, the U.S. is the largest market for these treasury companies. Such companies are still required to follow stringent capital reporting requirements and must work closely with regulated custodians, cryptocurrency exchanges, and market makers for successful execution of the strategies. Other regions are following suit, with Asian firms taking a more prudent approach, balancing risk appetite with regulatory robustness.

Currently, most treasury firms hold mainly Bitcoin and Ethereum, but some organizations are starting to accumulate other emerging high-quality assets, such as Solana, XRP, HYPE, SUI and others. According to current public data, publicly traded companies hold a total of 1,011,352 Bitcoins, or about 5% of all Bitcoins on the network, with MicroStrategy being the largest holder. Corporate positions in Bitcoin have doubled in size since 2025. Meanwhile, the Ethereum treasury companies’ total holdings of approximately 5.25 million ETH represent approximately 4.34% of the entire network's Ethereum.

2. Brief History and Development of DAT

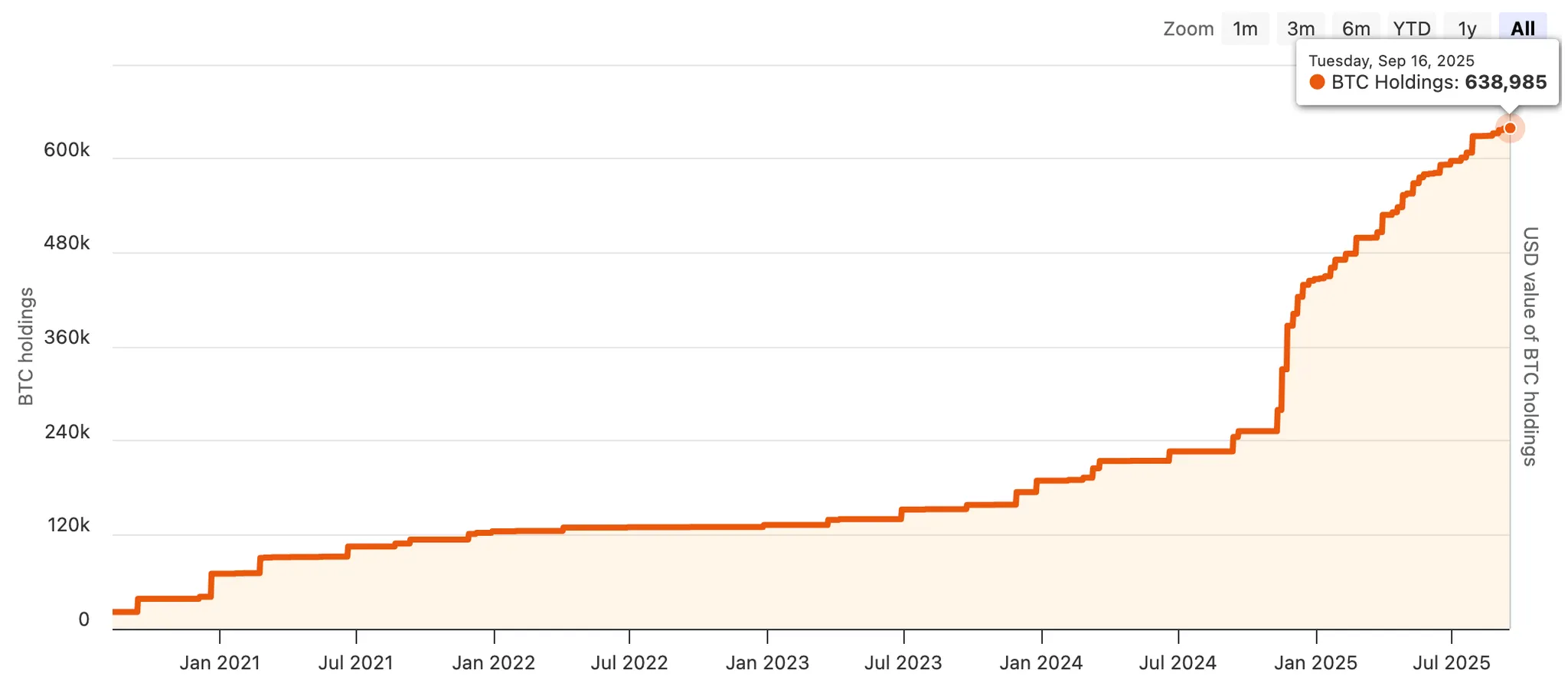

DAT first gained traction when MicroStrategy announced in December 2020 that its **Bitcoin purchases in 2020 totaled more than $1 billion.** Over the course of five years, MicroStrategy has increased its Bitcoin holdings several times through its own cash, bond issues, and stock offerings. As of September 16th, data shows that MicroStrategy holds 638,985 Bitcoins, making it the largest Bitcoin holding company.

MicroStrategy Bitcoin Holdings Chart. Source:Bitcointreasuries.net

According to MicroStrategy Bitcoin holdings data, MicroStrategy increased its Bitcoin holdings at a rate of less than 100,000 per year for the first four years, surpassing 200,000 in 2024, and approaching 200,000 Bitcoins in 2025.

BTC Purchased Per Year. Source: MicroStrategy – Bitcoin Holdings Timeline (annual increase)

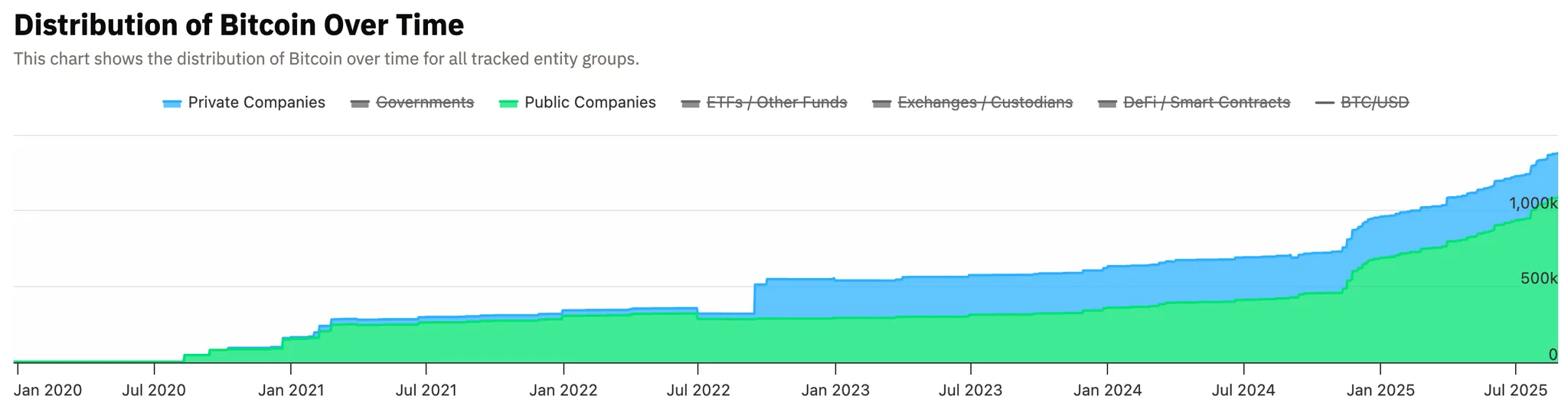

Based on the chart below on the adoption of Bitcoin treasury companies, MicroStrategy’s annual increase in Bitcoin holdings is accompanied by 64 additional publicly listed firms that began holding Bitcoin between the end of 2024 and the first half of 2025, bringing the total to 190 public companies. Alongside these, 64 private firms have also disclosed current or past Bitcoin holdings. Collectively, these public and private entities hold approximately 1,011,352 and 299,207 BTC, respectively.

The historical trend chart of Bitcoin holdings shows that the growth in Bitcoin holdings of publicly traded companies jumped at the beginning of 2021 and the end of 2024, primarily driven by several operations by MicroStrategy. Bitcoin holdings of unlisted companies jumped in the second half of 2022, mainly due to the inclusion of 164,000 bitcoins held by Block.one.

Distribution of Bitcoin Over Time, source:Bitcointreasuries.net

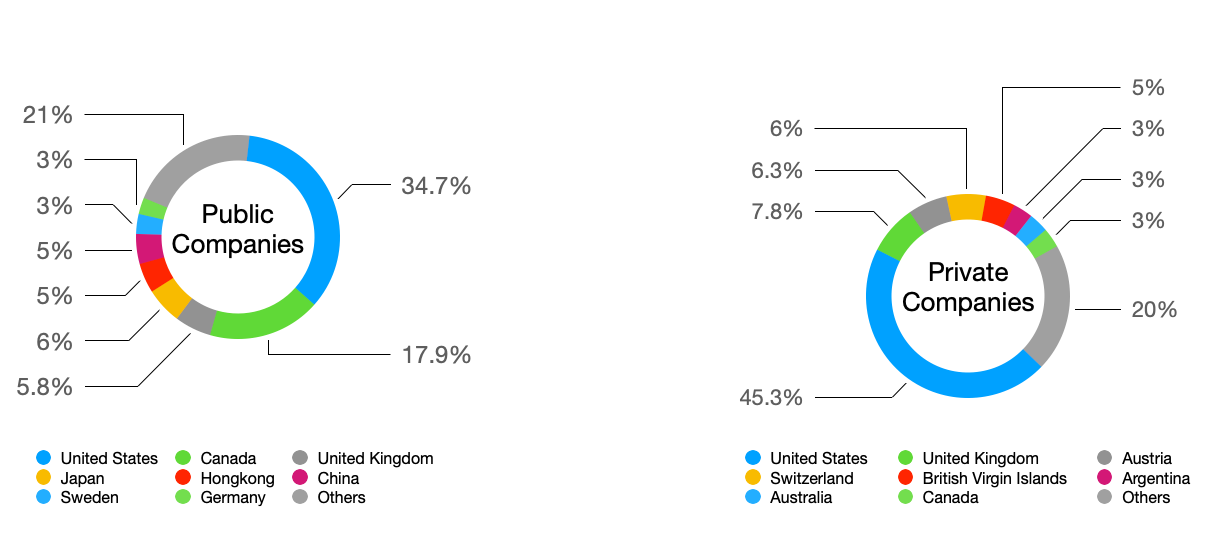

These Bitcoin holding companies span across countries, with half of the publicly traded companies coming from the U.S. and Canada, and nearly half of the private companies coming from the U.S., as shown in the pie chart data.

Bitcoin Holding Companies by Country. Source: Bitcointreasuries.net; compiled by HashKey Capital.

The evolution of Bitcoin DAT has been marked by consistent, steady participation across multiple companies and regions.

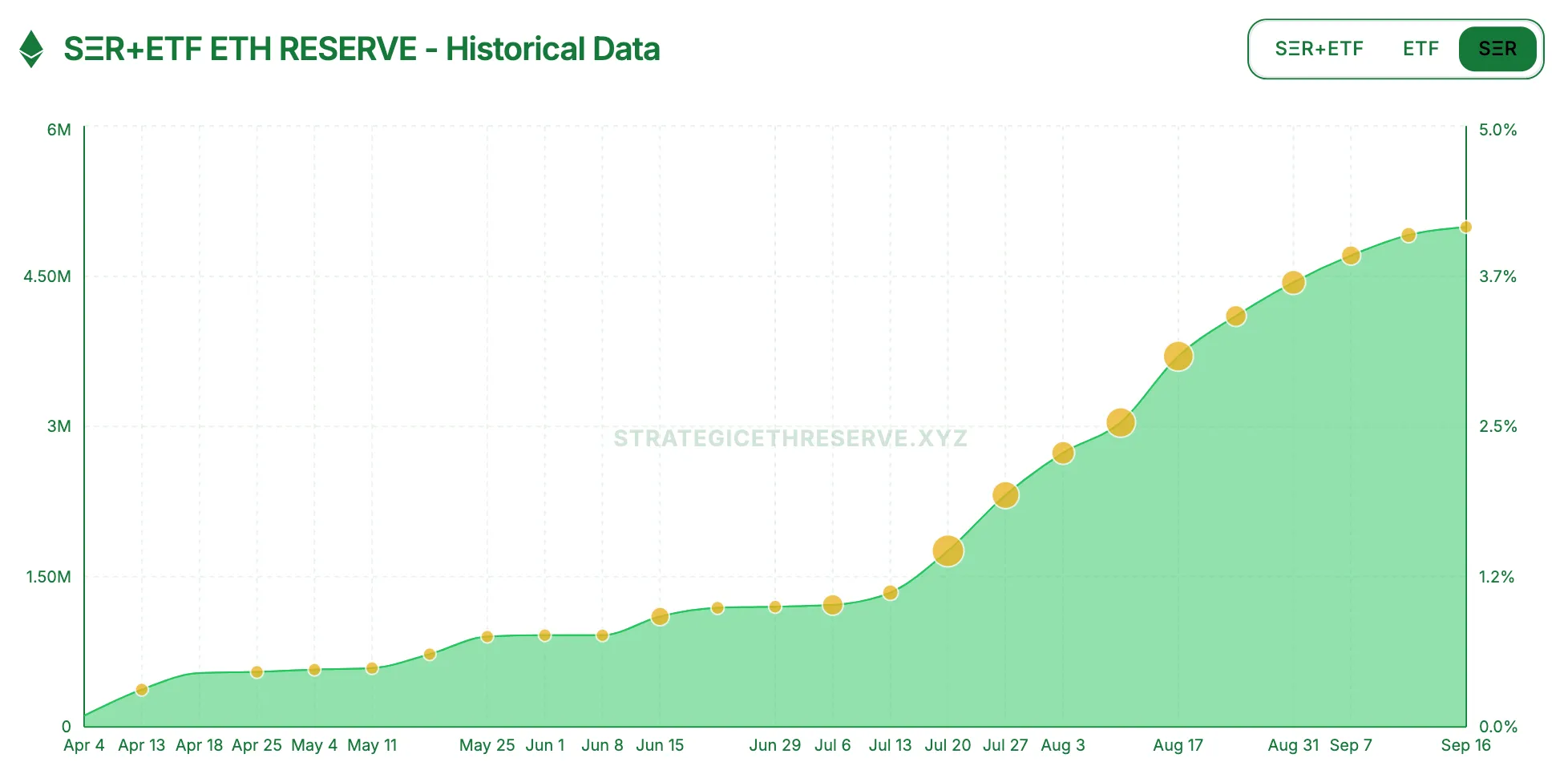

Over the past five years, the composition of DATs has become increasingly diversified, expanding beyond Bitcoin to include other large-cap digital assets such as ETH and SOL. Ethereum-based DATs emerged in April of this year and nearly doubled in size during July and August, reflecting a rapid acceleration in growth.

Ether DAT holdings trend chart, source:strategicetherreserv

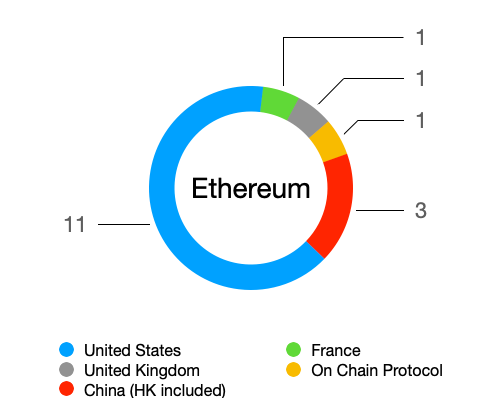

In comparison to Bitcoin DATs, there are 17 Ethereum-based DAT entities, collectively holding about 3.88 million ETH. The profiles of these 17 treasury companies consist of 15 listed companies, 1 is preparing to go public, and 1 is an on-chain agreement. The listed companies include 12 U.S. companies and 3 Chinese (Hong Kong) listed companies. There is a clear difference in this distribution compared to Bitcoin DAT, especially with the presence of one subject, the on-chain protocol ETH Strategy, whose tokens are STRAT issued at Uniswap. This situation stems from the differences in the technical aspects of Ether and Bitcoin, with Ether's smart contracts allowing the construction of complex DApps and therefore a richer ecosystem.

Ether holdings by country and region, source:strategicetherreserve, organized by HashKey Capital

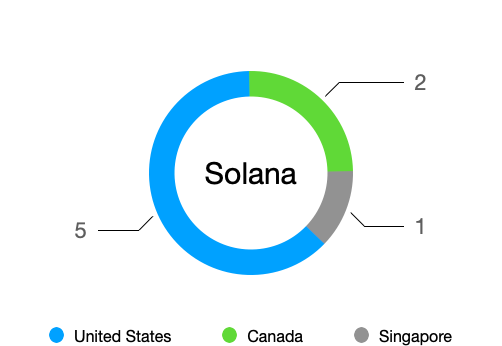

Solana is closely followed by eight listed entities in three countries, according to coingecko data.

Solana's holdings by country, source:strategicetherreserve, organized by HashKey Capital.

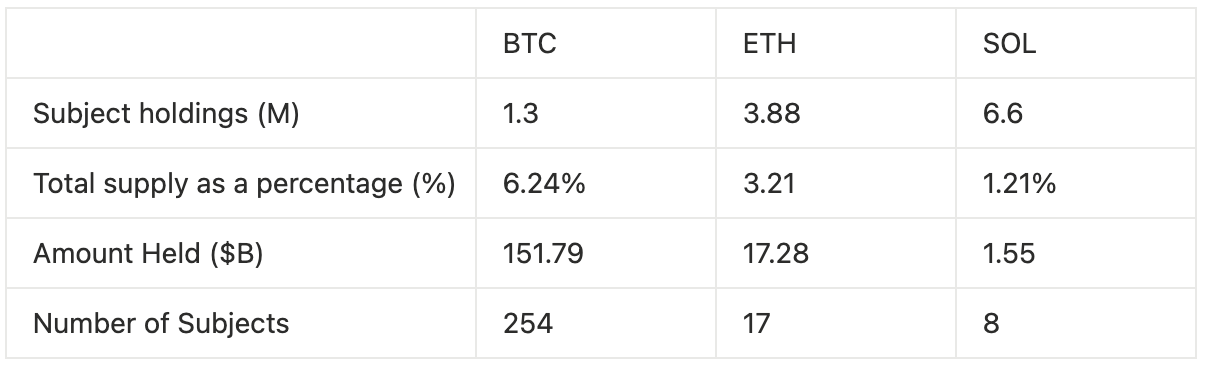

Bitcoin, Ethereum, and Solana are the main assets held by digital asset treasury companies. Below, we break down the key adoption metrics between DATs of these 3 assets.

*Data as of 2025/09/15, BTC holding subjects include subjects that used to hold and are now 0, all without ETF, DAO trearury, etc.

Statistical comparison of the three major DAT categories with BTC, ETH and SOL as the underlying assets, source:Bitcointreasuries.net, strategicetherreserve, HashKey Capital collation

From the table, we can learn that the number of companies holding BTC is much higher than that of Ethereum and Solana, reaching 15 times and 30 times of them respectively, a phenomenon that underscores Bitcoin’s value propositions as an asset diversification and inflation hedge.

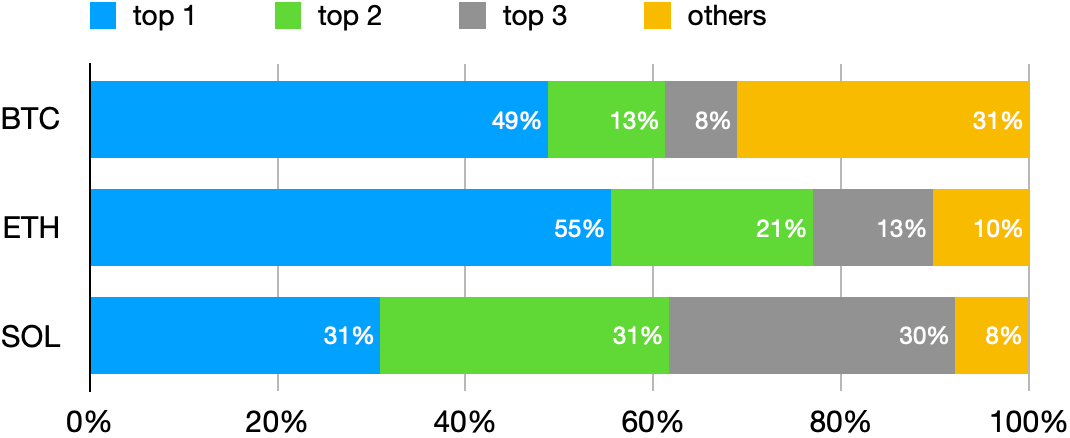

An analysis of DAT companies by asset market share reveals significant concentration risks. Among BTC DAT companies, MicroStrategy holds 49% of the market—substantially higher than the second-largest holder at 13%. While MicroStrategy’s dominance reflects scale, its outsized position and high BTC exposure conceal potential vulnerabilities. As a market bellwether, any sharp decline in Bitcoin’s price or disruption of its DAT strategy could pose systemic risks. For ETH DAT companies, concentration is even more pronounced: the largest holder controls 55%, followed by 21% for the second, with the top three collectively accounting for 90%. This indicates a highly unbalanced structure. By contrast, the SOL market is more evenly distributed, with the top three holders each maintaining roughly 30% market share, suggesting a relatively balanced market structure.

Comparison of the distribution of the positions of the three major DAT categories with BTC, ETH and SOL as the underlying assets, source:Bitcointreasuries.net,strategicetherreserve, organized by HashKey Capital.

Beyond BTC, ETH, and SOL, DATs also hold a range of other altcoins as underlying assets. These include public chain tokens such as TRX, SUI, and XRP; exchange platform coins like BNB; decentralized contract platform tokens such as HYPE; and even niche tokens like the Trump family’s WLFI. The value of these holdings varies widely, typically ranging from approximately $300 million to $2 billion. This continues to intensify going into Q3 2025, and we expect more DATs to emerge with other assets as underlying or hold a mix of cryptocurrencies or a mix of cryptocurrencies and DAT companies’ equity stake.

Multi-asset DATs are beginning to emerge. For example, Lion Group (LGHL) announced in September that it would convert all of its SUI and SOL holdings into HYPE tokens. In addition, some DATs have started investing in each other. A case in point is KindlyMD (NASDAQ: NAKA), a subsidiary of Nakagawa Holdings, which disclosed plans to participate in the international equity financing of Metaplanet, a Japanese company specializing in Bitcoin reserves.

3. Characteristics of DATs

Digital asset treasury (DAT) companies—whether single- or multi-asset—represent an emerging business model that both parallels and diverges from ETFs, traditional corporations, and other listed financial products. While they share baseline obligations such as financial reporting and regulatory compliance, DATs stand out through their heightened transparency in digital asset holdings, their ecological integration with the blockchain ecosystem, and their emphasis on aligning compliance standards with evolving digital finance regulations.

Strategy Openness as a Strategic Advantage

Firms are required to publicly announce their DAT strategy and disclose positions during financial reporting periods. However, several firms like MicroStrategy have taken the approach of voluntary disclosure beyond regulatory requirements that have enabled them to quickly gain trust and a premium in the market. MicroStrategy has also introduced a new metric called "Bitcoin Yield," which measures the percentage increase in the number of BTC held per share. This voluntary transparency helps attract investors who support a long-term strategy, while also serving the broader market by ensuring a clearer understanding of potential risks.

Ecological Synergy

The fate of DAT companies is deeply tied to the ecosystem of digital assets they hold. When a company holds a large amount of a certain token, it becomes a significant stakeholder in that blockchain ecosystem and thus has an incentive to invest resources in advancing the ecosystem. One notable example is BitMine Immersion, the largest ETH treasury holder, which actively participates in staking the Ethereum to maintain the network's security while generating additional staking yields. The company's own growth and the ecosystem's prosperity form a positive cycle - the company benefits from token appreciation and new revenue channels, while the ecosystem benefits from having less speculative activity surrounding its native token. This synergy generates shared value for DAT investors and project communities alike, while contributing to the long-term sustainability of the digital asset ecosystem.

Compliance Evolution

As U.S. regulation and accounting have evolved—most notably FASB’s move to fair-value accounting for crypto assets—DATs are becoming an increasingly common sight. What was once atypical (corporate direct holdings of volatile digital assets) is now addressed through clearer recognition, measurement, and disclosure frameworks in SEC filings. U.S.-listed DAT firms are subject to PCAOB-audited reporting and robust risk disclosures; many also adopt third-party, qualified custody and enhanced controls as best practices, even where not strictly required by rule. Meanwhile, the advent of spot Bitcoin and Ethereum ETFs offers compliant alternatives for investors and heightens expectations around governance, transparency, and risk management. Looking ahead, the convergence of traditional capital market regulatory frameworks and digital asset standards globally carved out new opportunities for DAT companies to benefit from crypto upside while being regulatory compliant.

4 Comparison with other financial instruments

A central perspective in assessing the investment value of DAT is to analyze it comparatively within the broader spectrum of financial instruments. We have selected direct investments in cryptocurrencies, cryptocurrency spot ETFs, and shares of DAT companies, evaluating them across four key dimensions: liquidity efficiency, price elasticity, leverage structure, and downside protection (see table below for details). Our analysis suggests that DAT is not a simple replacement for the first two financial instruments, but rather a more advanced, composite vehicle that combines the characteristics of both equity and crypto assets, providing a unique source of alpha for professional investors.

Beyond Beta: Seeking Structural Alpha

At its core, direct and ETF investing is about capturing cryptocurrency beta returns, i.e. the underlying returns of the market. However, DAT's investment logic goes beyond beta, with its core appeal being the acquisition of structural alpha.

Direct ownership delivers pure play exposure: returns move with the underlying coin.

Even with the benefits of compliance and convenience, ETF returns are essentially the underlying price performance net of the expense ratio—i.e., beta exposure.

For DAT investors, the source of return is diversified: it includes not only the appreciation of the underlying crypto assets, but also from secondary market discounts, smart leverage, cross-market arbitrage, onchain yield generation capabilities, and the execution of the management team. This alpha does not come purely from market volatility, but rather from the value creation capabilities from experts with both traditional finance and digital assets background.

Upgrading the Dimension of Risk Management: From Passive Exposure to Active Management Traditional frameworks often treat volatility as a risk to minimize.

By contrast, a well-structured DAT can treat market variability as a managed input—sometimes even a revenue source—through portfolio construction, balance sheet choices, and market microstructure tools. While direct coin holders and plain-vanilla crypto ETFs primarily deliver beta exposure (absent derivatives or overlay strategies), a DAT’s corporate toolkit enables more active risk and return management:

By issuing non-callable long-term debt (e.g., convertible bonds), DAT can magnify returns in bull markets, while in bear markets, its debt structure provides a cushion against the risk of mandatory liquidation due to margin calls.

When DAT's share price falls below its NAV (mNAV<1) due to market panic, this in itself attracts value investors and arbitrageurs, creating a built-in "safety cushion" mechanism, a dynamic risk-adjustment capability that the other two types of investment do not have at all.

In summary, DATs are not merely another route to hold cryptocurrencies; they are corporate vehicles that pair digital-asset exposure with balance-sheet and governance tools. For professional investors, DATs can complement direct or ETF holdings by potentially improving capital efficiency and enabling more active risk management—subject to mandate, governance quality, liquidity, and regulatory constraints. It represents not a replacement for the past, but an upgrade to the investment paradigm of the future. As Dr. Xiao Feng, founder of HashKey Group, says: "ETFs are good, but DAT is better". The "better" part comes from its alpha creation ability, which comes from deep expertise both in traditional finance as well as in the digital asset space.

5. The Significance of DAT

As a new vehicle for connecting the traditional financial world with digital assets, the emergence of digital asset treasury companies is significant in a number of ways:

DAT is a bridge for traditional investors to enter the crypto ecosystem

Similar to ETFs, DAT companies provide a bridge for investors who are unable or inconvenienced to hold cryptocurrencies directly. However, DAT operates more flexibly than ETFs, as many institutional investors (e.g., public funds, pensions, etc., in some countries) are constrained by regulation from directly purchasing Bitcoin or related ETFs but can buy shares of overseas listed companies. Consequently, the DAT structure can broaden the addressable investor base for crypto exposure and help channel traditional capital into the digital-asset ecosystem, subject to local regulations and investment policies.

High-profile corporate allocations—such as MicroStrategy’s initial Bitcoin purchases—also drew broad attention from corporate treasuries, brokers, and other financial institutions, contributing to greater institutional engagement with digital assets. In this sense, DAT companies have acted as a bridge between traditional capital markets and the crypto ecosystem, normalizing crypto exposure within institutional portfolios.

Empowering the blockchain ecosystem and realizing a closed loop of value

The rise of digital asset treasury (DAT) companies has introduced a meaningful new channel of capital into the crypto ecosystem, supporting a self-reinforcing value cycle. On the market side, DATs accumulate tokens in secondary markets and—where permitted—deploy on-chain yield strategies (e.g., staking or liquidity provision). These activities can deepen liquidity, act as token sinks, and support price discovery, potentially dampening speculative churn and helping to foster greater ecosystem growth.

This kind of growth flywheel can make ecosystem more mature and realize a win-win situation for DAT investors and the project.

Refocusing on Long-Term Value Amid Short-Term Volatility

The DAT model reframes attention from short-term price moves to long-term value creation. While crypto businesses are often tagged as “speculative” and “volatile,” DATs emphasize building per-share net digital asset value rather than trading around quarterly fluctuations. For example, Caikou has stated that its core financial objective is to grow net digital asset value per share over time. In practice, this means management prioritizes sustained coin accumulation and the long-run fundamentals of the underlying assets, instead of opportunistic buying and selling to manage near-term P&L. As investors begin to assess DAT companies through a value-investing lens, the segment’s valuation framework can become more disciplined and stable. When long-horizon capital (e.g., value-oriented funds) starts investing in these companies in future, this improves the investor mix and may help temper extreme swings in both equity and token prices.

Ultimately, the focus shifts from short-term speculation to long-term asset compounding: the central question becomes whether the company’s per-share stack of Bitcoin/Ethereum—and the underlying networks’ fundamentals—are likely to be worth more in five to ten years. If so, interim drawdowns are less concerning. This mindset encourages more long-term holders and can support healthier, more resilient valuations across the digital-asset space.

Conclusion

Situated at the nexus of traditional finance and digital assets, digital asset treasury (DAT) companies act as bridges, enablers, and anchors. They broaden access by channeling traditional capital into crypto, expanding both the investor base and market acceptance. Their operational discipline in strategic accumulation and transparent reporting also foster a more mature ecosystem, strengthening regulatory alignment and a long-term fundamentals lens. Collectively, their rise underscores a broader participation in the digital economy: more companies are beginning to treat digital assets as strategic resources to be allocated and actively managed.

Our next report details the playbook for launching and running DAT companies and outlines a practical, investor-oriented approach to valuation.

References

肖風香港演講全文:DAT 比 ETF 更好 我眼中的數字資産金庫, https://www.finet.hk/newscenter/news_content/68b3c092800d457d2ca09e3e

The Rise of Digital Asset Treasury Companies (DATCOs), https://www.galaxy.com/insights/research/digital-asset-treasury-companies

Digital Asset Treasury Strategy ****https://crypto.com/en/research/dat-strategy-coms-jul-2025

Cryptocurrencies in the Balance Sheet: Insights from (Micro)Strategy - Bitcoin Interactions https://arxiv.org/pdf/2505.14655

Adding Bitcoin to a Corporate Treasury https://www.fidelitydigitalassets.com/research-and-insights/adding-Bitcoin-corporate-treasury