HashKey Capital Monthly Insights Report: July 2025

HASHKEY CAPITAL

Reading Time: 22.68Min

HASHKEY CAPITAL

Reading Time: 22.68Min

Overview

July 2025 proved to be a milestone month for crypto markets, balancing new price highs with historic regulatory breakthroughs. Bitcoin soared past its previous peak, reaching a record ~$123,091 on 14 July amid greater regulatory clarity in the US which passed a trifecta of crypto bills (the GENIUS Act, CLARITY Act, and an anti-CBDC measure) through the House with broad bipartisan support during the US Crypto Week. This culminated in President Trump signing the GENIUS Act — the nation’s first federal crypto law — on July 18, establishing a regulated framework for stablecoins and validating the mainstream adoption of dollar-backed stablecoins. Additionally, the SEC has also approved in-kind redemptions for all spot BTC and ETH ETFs, paving the way for greater institutional adoption of digital asset treasury moving forward. The total crypto market capitalization swelled to $3.85T since then as sentiments turned from neutral(50) to greed(62) in July.

The broader macro sentiment turned risk-on after several breakthroughs in major trade impasse — President Trump struck tariff deals with major trading partners like the EU and Japan, which lifted global markets and crypto alike. Constructive trade negotiations between US and China with plans to extend the tariff deadline also lifted market unease. Despite lingering geopolitical, inflation concerns, and Fed’s reluctance to cut rates, risk assets showed resilience. U.S. equities hovered near all-time highs on cooling trade tensions. Overall, July 2025 was marked by positive regulatory developments and easing geopolitical tensions.

Bitcoin

Bitcoin’s rally continued in July, appreciating 11% MoM with a YTD return of 26.89%. The rally was fueled by multiple tailwinds: institutional demand remained robust and regulatory optimism. On July 14, BTC surged over $120,000 for the first time ever — peaking around $123,153 — as investors bet on impending U.S. policy wins during US Crypto Week. Institutional demand remains healthy with its BTC ETFs notching its 4th consecutive month of growth, bringing in more than $6.1B in net inflows. Large Bitcoin treasury companies like Microstrategy. Twenty One Capital, Bitcoin Standard Treasury continued their accumulation, coinciding with a decline in Bitcoin on exchanges. However, Bitcoin mining companies continue to face a challenging environment as the hashrate increased from 879 EH/s to 909 EH/s in July, causing the hashprice index to fall. Bitcoin mining firms experienced a mixed performance. Marathon Digital smashed previous records in revenue, net income, adjusted EBITDA through having better energy efficiency driven by its S21 Pro roll-out, competitive energy costs, and a larger share of hashing power. Others like Core Scientific, and Bitdeer saw declines in revenue which can be attributed to halving events, and higher hashrate.

Bitcoin dominance declined markedly from 65% to 60% in July as altcoin season gained traction led by a wave of institutional demand for ETH ETFs and ETH treasury strategies. The ETH/BTC ratio accordingly rose to levels reminiscent of levels not seen since January 2025.

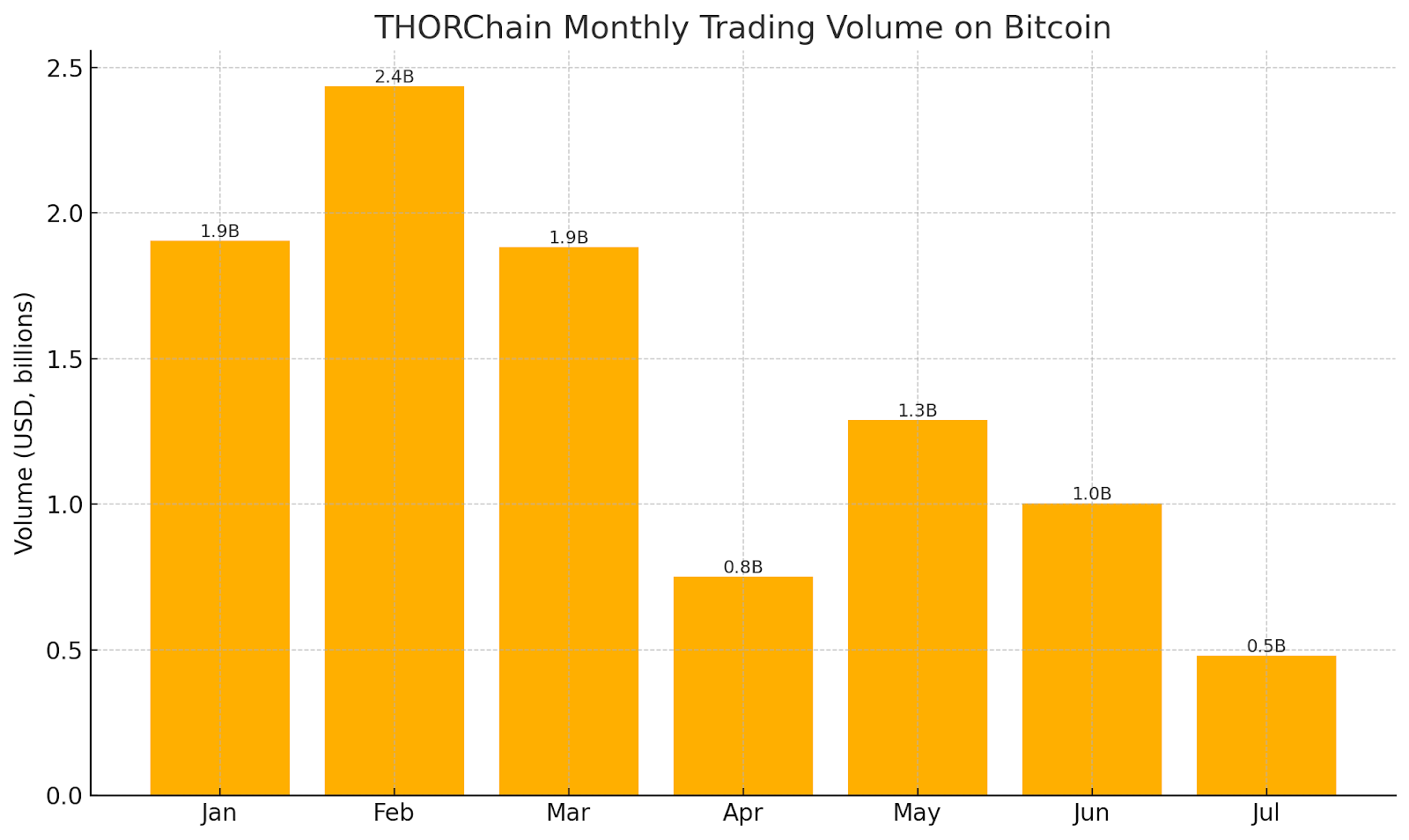

The upswing in investor sentiment was mirrored by higher on-chain activity on the Bitcoin network. Bitcoin treasury strategy continues to be viewed favourably by institutions as July witnessed more than $6.5B in announced Bitcoin acquisition which likely drove increased onchain activity, with large Bitcoin holders looking to optimize their yields. Key sector beneficiaries include BTC restaking protocol like Threshold network’s tBTC which saw a MoM growth of 7% in Bitcoin denominations. Lending and stablecoin protocol, Yala, also saw notable growth of 43% MoM in terms of BTC TVL, underscoring real world yield opportunities in Bitcoin beyond just store of value. Consequently, this led to a 22.25% MoM growth in network transactions to 12.7M and a 7.93% MoM growth in network fees to $16M. However, performance is unevenly as retail adoption appears to be waning as daily active address declined by 2.47% MoM to 493,829 while returning users saw a more notable decline of 8.13% MoM. DEX volume on Thorchain DEX on the Bitcoin network also halved in July.

Ethereum and L2 Networks

Ethereum started July on the back foot but finished strong, as capital rotated from other networks to Ethereum, spearheading a monthly gain of 46.81%.

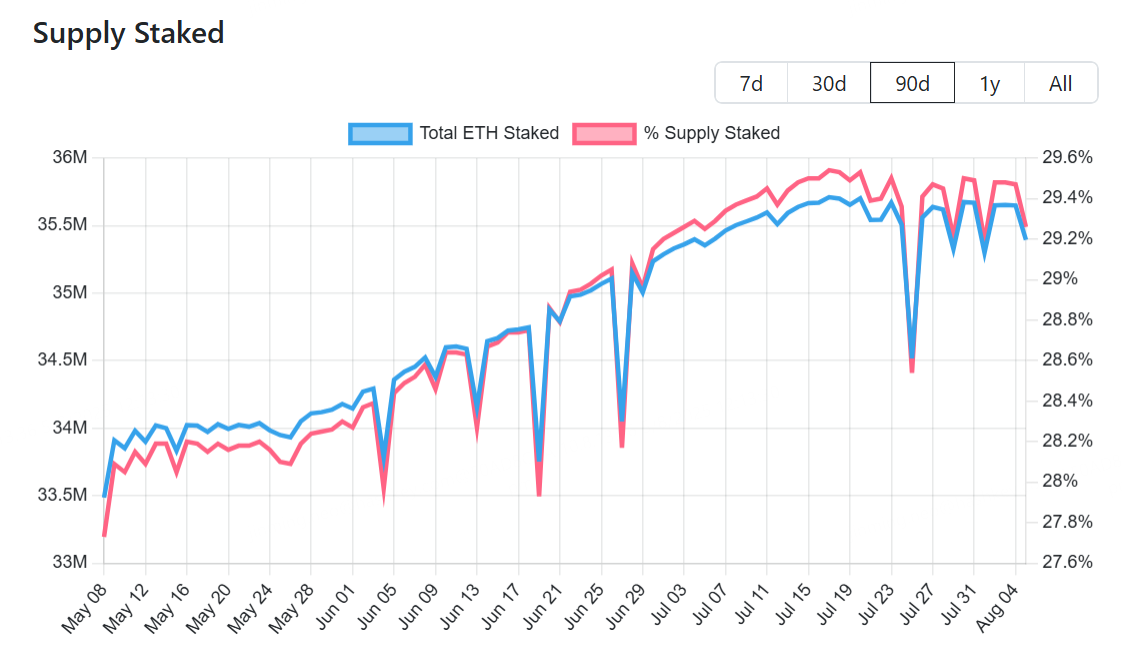

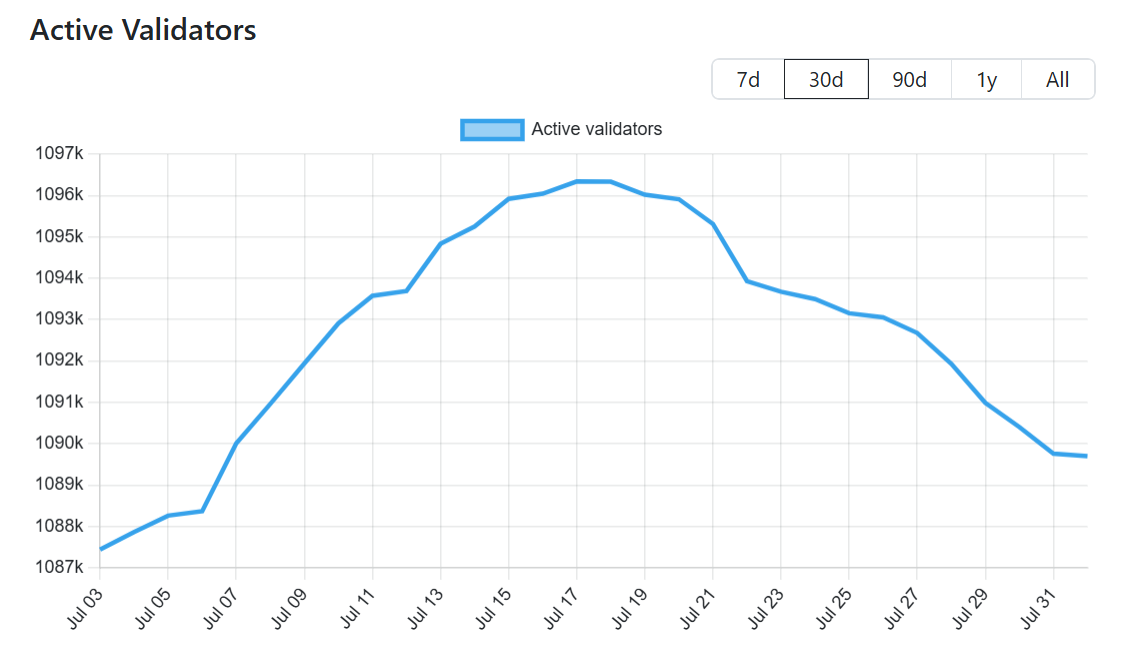

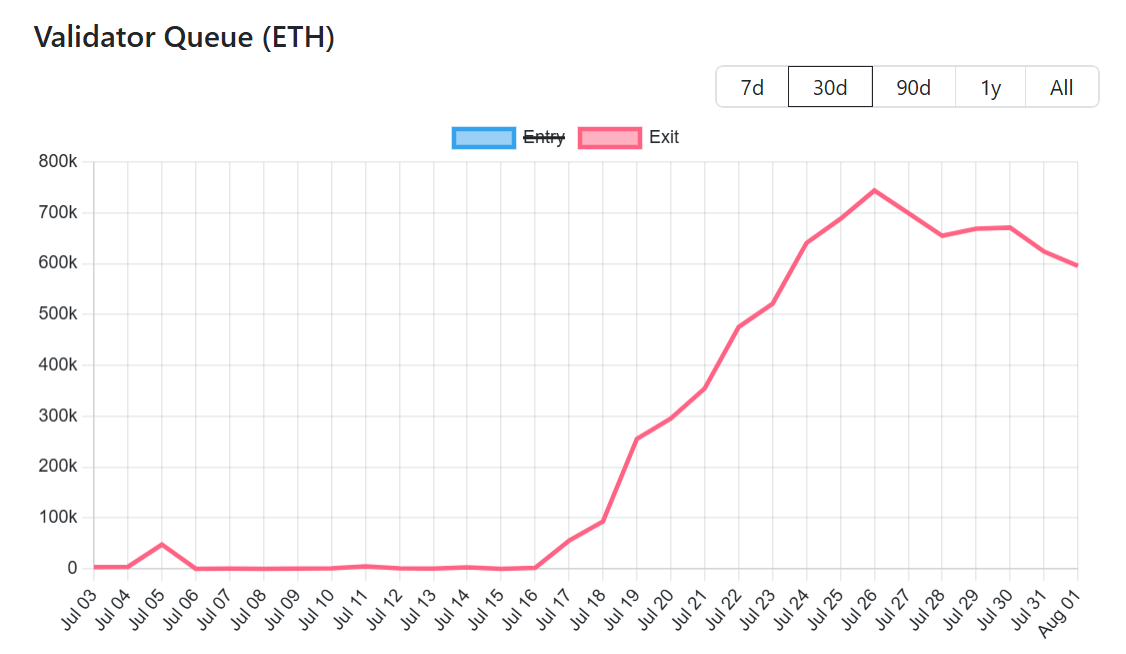

This can be attributed to the renewed institutional interests with historic ETH ETFs inflows of $5.4B in July and a flurry of Ethereum treasury announcements. With 20 consecutive days of net ETH ETF inflows, total AUM of ETH ETFs now absorbs ~4.5% of all circulating supply. Central to the strong performance of Ethereum is also the institutional adoption of ETH corporate treasury. BitMine Immersion Technologies is now the largest holder of ETH treasury with more than 600,000 ETH worth over $2B. Sharplink Gaming comes second with more than $1.6B in holdings. Leveraging on the same playbook pioneered by Strategy, these companies also intend to turn Ethereum into a productive asset with yield generating potential. Staked ETH reached a peak of 29.54% in mid-July, although that subsided with exit validators drastically increasing from less than 1,000 daily to more than 744,000, led by a surge in borrowing rates on Aave. After AAVE’s lending pool saw a withdrawal of around 167,000 ETH, WETH borrow rates went above 10%, forcing leveraged traders to close their positions to derisk. This has however tapered down to a yield of around 2.77%.

Ethereum DeFi TVL demonstrated strength in July, increasing by 34.43% MoM to $83.83B. Compared to June’s subtle growth, July’s expansion indicated greater confidence and interest in the ecosystem amid greater regulatory clarity and institutional demand. Since SEC clarified that most staking services are not classified as securities, hence excluding them from the purview of SEC, staking and restaking have become key beneficiaries.

Liquid staking and restaking platforms TVL growth

With Ethereum corporate treasury strategies gaining traction in July led by Bitmine Immersion and SharpLink Gaming, institutional flow has led to increased demand for productive yields in asset treasury leading to strong performance of staking and restaking protocols in July.

Additionally, EigenLayer’s recent focus on EigenCloud following its $70M fundraising in June has also attracted capital flow to restaked ETH, with its TVL increasing from $11.66B to more than $16B amid a more mature platform. EigenLayer’s redistribution feature went live on mainnet, an extension of its slashing functionality, allowing slashed funds to be redistributed for various purposes like lending, insurance etc.

With Ethereum bringing in more than $2.5B in netflow to the ecosystem, this has transpired into greater onchain speculative activity. Aave, Uniswap and Pendle all recorded an increase of 27.91%, 14.32% and 35.94% MoM in TVL. Aave’s growth can be attributed to several notable developments in July. It partnered with Ethena Labs to introduce an incentive campaign for sUSDe-USDe pair where depositors are able to earn USDe rewards and sUSDe’s native yields. Metamask, the non-custodial wallet, has also introduced stablecoin earn in its wallet, allowing users to earn yields from their stablecoins deposited into Aave. Uniswap registered strong momentum, posting a 14 % increase in monthly transactions and a 20.97% rise in trading volume. Uniswap TVL on Ethereum has also increased coinciding with a netflow of more than $515M from Unichain to Ethereum. While v3 is still the dominant version, v4’s market share of trading volume compared to v3 on Ethereum has surged from 39.44% to 53.87%, in line with our expectations mentioned in our June report that v4 customizable hooks that enable customized DeFi execution strategies will drive more liquidity and optimized capital efficiency. v4 trading volume on Ethereum has also surpassed Unichain in July, amid greater institutional interests in Ethereum.

Overall, amid the greater institutional interest and regulatory clarity, Ethereum witnessed one of its best months recording significant growth across metrics. Moving forward, senior researcher at Ethereum Foundation, Justin Drake, has unveiled his ‘Lean Ethereum’ vision, which aims to scale the base layer to 10K TPS and L2s to 1M TPS within the next 10 years, while also ensuring quantum resistance and zkVM adoption.

Performance of Ethereum in July

Significant capital inflow into Ethereum has resulted in relative underperformance of its L2. The ratio of monthly active L2 users to L1 users declined from 6.5x in June to 4.8x in July and L2 transaction counts correspondingly fell from 16x to 15.3x. Regulatory clarity in the US has disproportionately benefitted Ethereum as institutional capital and retail users return back to Ethereum to leverage its deep liquidity and mature, vibrant ecosystem. While competition has intensified, L2s remain a fundamental part of the Ethereum ecosystem as we explore some notable developments in July.

Linea

Linea announced its LINEA tokenomics with 85% allocated to ecosystem development and 15% allocated to Consensys treasury. Linea will also be aligning itself to drive greater value alignment with Ethereum. Gas fees will be paid in ETH and 20% will be used to burn Ethereum while the rest will be used to burn LINEA. Governance and protocol development will be overseen by the Linea consortium that includes ENS Labs, Eigen Labs, SharpLink, Consensys among others which will help with emissions, grants, incentives, ecosystem initiatives.

After 6 months of consecutive declines, Linea onchain activity bucked the trend in July amid the rise in speculative activity as its native token, LINEA, inches closer to TGE.

Linea Peformance in July

Lending platforms on Linea recorded strong growth in July with ZeroLend and Aave boosting their TVL by 23.16% and 68.93%, respectively.

DEX activity has also accelerated, with $174.2M in monthly DEX volumes, increasing by 5.83% MoM. On July 28, the Linea team announced the launch of Etherex, a new metadex built in collaboration with Consensys. Its native token, REX, can be staked for xREX, which in turns providers eligible tokenholders with 100% of protocol fees and vote incentives. Etherex is also natively integrated with Metamask allowing the platform to become the default swap destination when it offers the best pricing. Leveraging the x(3,3) model, an enhanced version of the metaDEX, by providing a liquid voting token REX33 for users to easily exit their staked positions. Within 4 days, the platform has seen more than $7M in TVL.

Base

Base saw a mixed performance in July as DeFi activity grew, with DeFi TVL and DEX volumes increasing by 24.05% and 33.69% respectively which can be attributed to the launch of flashblocks, delivering a more seamless user experience through 10x faster trade confirmation. Perpetuals volume on Base also grew, breaching $10B in monthly volume, led by Avantis which occupies a 45% perpetual trading market share, overtaking SynFutures to become the top perpetuals trading platform. With up to 500x leverage, 0 fees, and offering retail access to commodities(gas, oil, gold) and forex, interest on the platform skyrocketed in July, reflected by a 2x increase in trading volume. Additionally, Binance Wallet has also integrated Avantis, boosting its user accessibility. As perpetuals competition heated up, SynFutures saw its Base trading volume drop over 30% to $2.8B, while broadening its offering with gold and oil to capture additional activity.

Despite the growth in DeFi activity, engagement has become more concentrated within a narrower user segment; as retail capital shifts back to Ethereum, both active addresses and monthly transaction volumes have declined.

Base Performance in July

Other notable announcements:

Base team announced a 12 month incentive campaign by Thrive Protocol, a web3 community growth platform for various projects, that will manage the distribution of 3M OP tokens, awarded by Optimism and sponsored by Base.

PancakeSwap Infinity (PancakeSwap v4) launched on Base.

As part of the ‘New Day One’ initiative announced by the Base team, the plan aims to foster greater adoption of its offerings including Base App, Base Build, Base chain, Base accounts and Base Pay.

Coinbase has acquired the leadership team of Opyn Markets.

Arbitrum

Arbitrum continued to witness strong momentum in July with adoption and usage both showing healthy growth. Daily active address and monthly transactions grew by 6.86% and 26.79% respectively with Arbitrum becoming popular among stablecoin users. Monthly stablecoin transfer volume on the network grew from $59.6B in June to $92.9B in July, clocking a 59.87% MoM growth. DeFi activity also marched in lockstep with broader ecosystem adoption as DEX volume soared 20.96% MoM to exceed $20B. Notably, DEX volume on Uniswap increased by 6.67% MoM, taking up more than 50% of all DEX volumes on Arbitrum. Camelot DEX, which processed $1.73B in July, witnessed a 44.2% growth in transactions processed MoM. With DeFi being a key sector within Arbitrum, delivering fast transaction guarantee, seamless trade execution have become essential for the network. Launched in April 2025, Timeboost — Arbitrum’s priority-fee mechanism for faster execution and reduced slippage — has already generated more than $2M in cumulative revenue, underscoring the platform’s transition to support larger DeFi volumes. In recent months, it has accounted for nearly half of the network’s fee income, highlighting its rapid uptake among users executing high-frequency and sophisticated DeFi strategies.

Arbitrum Performance in July

Other notable announcements:

PYUSD added to Arbitrum.

Arbitrum joins as a new member of the Tokenized Asset Coalition.

ULTRA, a tokenized US treasury fund launched by Libeara’s tokenization platform, now live on Arbitrum.

Gemini launched tokenized stock trading for EU users on Arbitrum.

GMX V1 was exploited although most of the funds were returned after the hacker accepted a $5M white hat bounty.

If Q3 brings further regulatory clarity (e.g. a U.S. Digital Asset Market Structure law that could serve as the next leg of catalyst clarifying ETH’s commodity status), Ethereum is poised to benefit disproportionately given its extensive ecosystem. The main watchpoint remains competition from other chains and ensuring greater institutional adoption beyond treasury strategies into sectors like RWA.

Other L1s

Aptos

While other chains recorded strong performance in July, the same cannot be said for Aptos as it faced intensifying competition from other networks with significant outflows in July heading to Ethereum, Solana and Sui. This resulted in a mixed performance across metrics. DeFi TVL fell 15.1% MoM led by declining deposits in lending platforms. Aries Markets, the largest lending platform on Aptos, saw a 25.7% MoM decrease in TVL with significant outflows exceeding $75M on 10 July, 23 July, 26 July and 27 July. With yields for other supported assets lower than USDC and USDT, it is not surprising to see the 2 largest stablecoin dominate utilization on the platform which has a platform utilization rate of around 50%. In contrast, DEX activity strengthened, with trading volumes increasing 28.6% MoM to reach $7.2B in July. The largest DEX on Aptos, Hyperion, continues to see strong traction as trading volumes hit $4.1B, representing 24.2% monthly growth and dominating DEX activity on Aptos.

Aptos Performance in July

Other notable announcements:

WBTC now live on Aptos mainnet.

Aptos joins as a new member of the Tokenized Asset Coalition.

Sui

Compared to its counterpart, Aptos, Sui’s ecosystem shows a more optimistic and consistent performance in July in terms of usage and adoption. Daily active address more than doubled, inching close to 1M daily active users. Monthly transactions also grew by 30.3% to 144.8M. Sui’s DeFi ecosystem continues to expand with TVL breaching $2B. The surge can be attributed to BTCFi growing maturity on the network as incentive campaigns by OKX, Satlayer, Bluefin, Navi Protocol and Momentum boost adoption of BTCFi within Sui. Lending platforms such as Suilend ended the month with more than $700M in TVL, as BTCFi heats up, bringing in net deposits of LBTC and WBTC throughout July. Yield aggregator and DeFi vault platforms like AlphaFi and Haedal recorded MoM TVL growth of 50.4% and 20.25% respectively. DEX volumes grew by 76.54% to $14.3B in July led by DEX platforms like Momentum and Cetus. Trading volume on Cetus more than doubled from June, reaching $6.16B. Since its launch on 31 March 2025 coupled with a WAGMI trading competition that runs from June 6 to September 8, trading volume on Momentum has reached an all time high in July with $2.36B processed. Its partnership with OKX Wallet for boosted yields when staking BTC or Sui assets have also lifted the TVL on the platform by 38% to $155M.

While Base is well known as a socialfi hub, socialfi platforms on Sui remain underrated despite their rapid growth. Recrd, a platform which allows creators to monetize short videos on Sui, has more than 485K daily active users. FanTV, another content creation platform, has more than 180K daily active users in July. Both platforms have also become the top 5 applications in gas consumption on Sui contributing significantly to ecosystem diversity. When compared to Farcaster’s estimated 30K daily active users, it is evident that Sui has quietly become a popular destination for consumer applications.

Sui Performance in July

Other notable announcements:

Mill City Ventures closed a $450M private placement round to accelerate the growth of SUI corporate treasury.

Sui underwent an upgrade on 29 July following a security audit by Mysten Labs. The upgrade introduced stricter signature validation and linkage checks to address potential vulnerabilities.

Kraken allows staking for SUI.

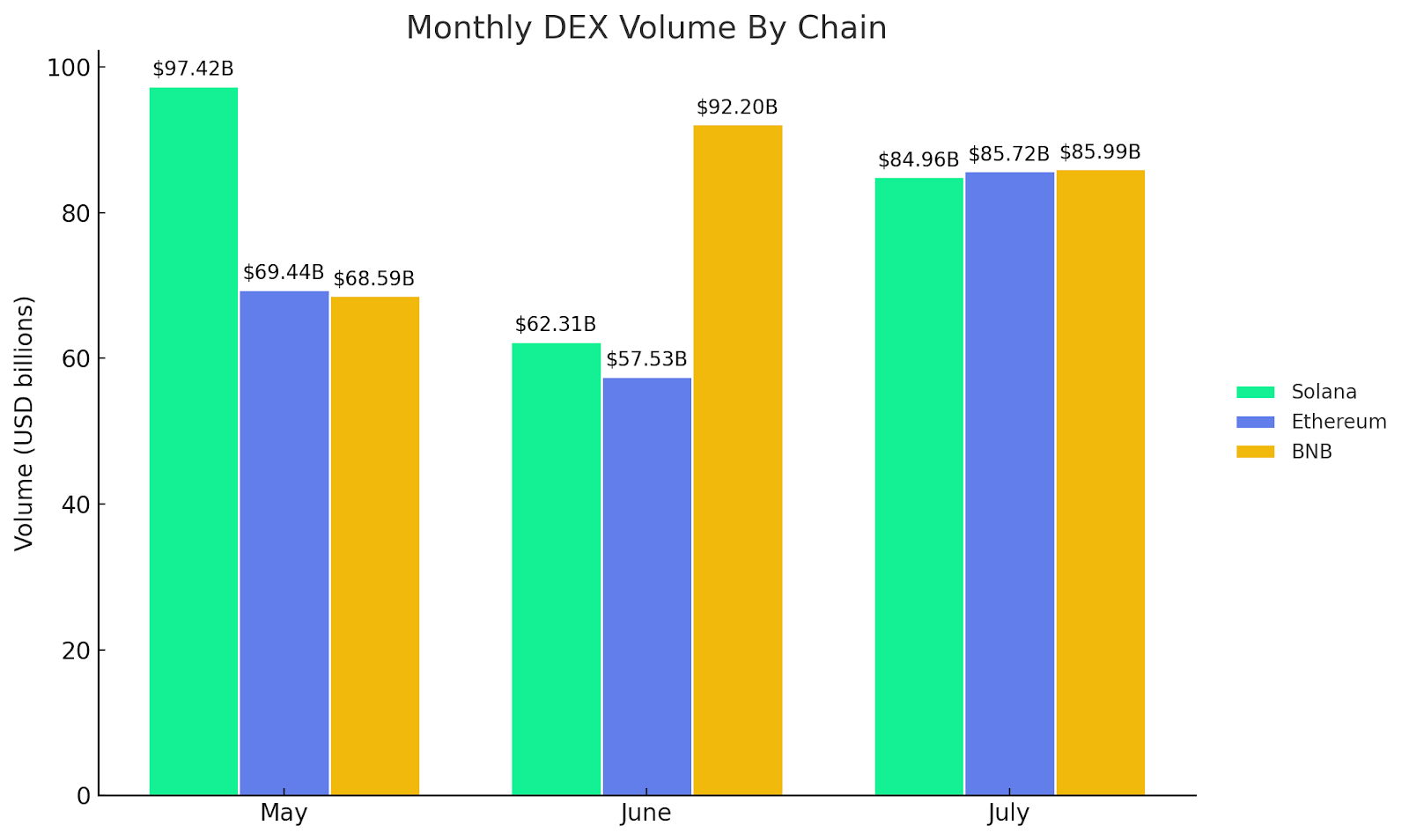

Solana

Despite seeing a dip in daily active users, Solana continues to exhibit strength across other metrics as onchain activity and institutional demand led to a 11.4% increase in Solana token price. DeFi applications remain the top use case for Solana, with Pump.fun, Raydium, and Jupiter having the top 3 highest number of daily active users. While interest on pump.fun has waned significantly since the inception of other competitors, the overall launchpad landscape on Solana remained vibrant. In July, Raydium’s Launchlabs generated $3.7B in trading volume, more than 12x the volume recorded in June led by the success of Letsbonk.fun which now occupies 64% market share in launchpad trading volume. Renewed interest in memecoin trading, which takes up close to 50% of all DEX volume, led Raydium DEX market share to 35%. Meteora and Orca also increased their monthly DEX volume by 72.08% and 48.16% respectively, underscoring risk on sentiment among investors. DeFi TVL increased by 13.08% MoM led by a resurgence in lending and liquid staking. The largest lending platform on Solana, Kamino, grew by 12.13% MoM, with TVL exceeding $2.68B in July. Liquid staking platforms saw renewed interest driven by greater institutional interests. Solana treasury companies almost doubled their Solana holdings in July, which now accounted for 0.64% of Solana supply. Sanctum’s TVL increased to $2.39B, representing a 26.46% MoM growth driven by the recent launch of DoubleZero staked SOL, DeFi Development Corp Staked SOL, MoonPay staked SOL underscoring the diversity and demand for liquid staked solana. Liquid Collective launched its own liquid staked Solana, LsSOL, aimed at institutional investors. The July 1 debut of the REX–Osprey Solana Staking ETF underscores a shift among institutions toward capital-efficient exposure — not just price appreciation — providing a tailwind for staked Solana growth.

Solana Performance in July

Other notable announcements:

Solana joins as new member to the Tokenized Asset Coalition.

Mercurity Fintech raised $200M strategic investment from Solana Ventures to accelerate solana treasury.

Anza announced its Internet Capital Markets Roadmap with an aim to enhance central limit order book performance and transaction processing.

REX Shares announced that JitoSOL has been integrated into its REX-Osprey Solana Staking ETF.

Ripple’s XRPL EVM Sidechain

The XRPL EVM sidechain, which went live on 30 June 2025, gained rapid traction in July. Developers had deployed 86 verified contracts, and the network had already processed over 35K successful transactions with an average transaction fee below 0.03 XRP. By 10 July, total value locked (TVL) had surpassed $105 million, buoyed by early integrations such as Doppler Finance, a yield-generating protocol now holding more than $42 million in TVL and seamless cross-chain inflows enabled by Axelar bridging. RLUSD, issued by Ripple, reached a market supply of $65M. Together, these metrics suggest the sidechain is quickly establishing itself as a credible EVM-compatible venue within the XRP ecosystem, attracting both developers and capital.

XRPL EVM Sidechain Performance in July

Stablecoins

Stablecoins continued to anchor liquidity in July, with both supply growth and regulatory validation reinforcing their systemic role. The total stablecoin market cap rose steadily — in July it was up +5.11% to $266.58B. Adjusted stablecoin transactions reached $2.6T, up from $2.1T in June, alongside the growth of stablecoin addresses to reach all-time-high of 45.8M. This expansion is a direct reflection of the demand for stablecoins since the passage of the GENIUS ACT in the US, which aims to cement the role of stablecoin within the financial infrastructure. Stablecoin transactions in North America increased its share (37.3%) against other regions in July, amid intensifying competition in the US to capture a slice of the booming market. Tether’s USDT netted in more than $6B, overshadowing USDC’s $2.37B inflows. This highlighted market optimism in the largest stablecoin provider to eventually comply with US regulations within the stipulated timeline, with most of its inflows going to Ethereum, Tron and BNB. Meanwhile, USDC flows have mainly moved to Hyperliquid and Solana. EURC and PYUSD saw their active addresses more than doubled in July. Euro stablecoins have been gaining traction lately, with EURC capturing a monthly transaction volume of $17.7B across 199.3K monthly active addresses. Paypal’s latest initiative allows merchants to accept any cryptocurrencies for payments which will be converted into PYUSD, fuelling the ascent of the stablecoin that now has exceeded $1B in circulating supply. Ethena’s USDe once again saw renewed demand as funding rates for Bitcoin and Ethereum grew beyond 10%, leading to capital inflows of more than $2.9B looking to benefit from the 11% APY in sUSDe. Last but not least, USDf, a synthetic stablecoin issued by Falcon Finance, had its best month in July, more than doubling its circulating supply to $1.08B. By allowing various asset deposits including ETH, BTC, USDT, USDC and maintaining an overcollateralization ratio of 115%, the protocol is able to provide yields of around 12% through diversified yield strategies.

Other notable developments:

Visa adds support for Stellar and Avalanche blockchains for its payment settlement network. PYUSD, USDG, and EURC will also be integrated.

PYUSD expands to Arbitrum.

Plasma, a high performance L1 built for stablecoin, announced its testnet and completed the public sale of XPL, raising $343M.

Ripple’s RLUSD to be used in Hidden Road’s cross margin trading platform.

Clearpool introduced cpUSD.

Stablecoin Performance in July

Real-World Assets

RWA accelerated in July, emerging as one of the hottest trends at the intersection of crypto and traditional finance. In July, the market capitalization of RWA grew 2.8% MoM to cross $25.2B. Tokenized equity has emerged as one of the key areas ripe for growth, encouraged by a more innovation-friendly regulator in the US. The SEC has recently announced ‘Project Crypto’ which aims to modernize securities trading on blockchain networks. SEC Chairman, Paul Atkins, has also noted the slew of companies that have indicated interest to tokenize their stocks while providing assurance that the agency will offer appropriate assistance to these requests aligned with regulatory compliance. Since our June thematic spotlight on tokenized equity, Backed Finance’s xStocks platform has generated almost $100M in cumulative trading volume, spanning 61 assets and attracting 27,000 new users. With greater regulatory clarity in sight, Coinbase has announced it will launch tokenized equities, and prediction markets to US users in the coming months.

Private credit market TVL grew by 6.58% MoM to more than $15B led by growth in Maple Finance and Tradable. Active loans on Tradable increased from $2.08B to $2.19B driven by attractive average base APY of 11% and no default loan till date. Active loans on Maple Finance grew from $816M to more than $1B in July as TVL crossed $3.18B in July. This feat now positions Maple Finance as the largest onchain asset manager, dwarfing BlackRock’s BUIDL. With more than $15M ARR, Maple Finance has also passed a proposal (MIP-018) increasing $SYRUP token buybacks from 20% to 25% using protocol revenue from Q3 2025, rewarding long term tokenholders.

The tokenized real-estate sector is rapidly gaining traction as well, fuelled by robust investor interest and a series of notable developments in July. DL Holdings announced that it is tokenizing $500M worth of real world assets which include interests in DL Tower, treasuries and other real world assets via its partnership with Asseto Finance. In Japan, tokenized real estate is a dominant RWA narrative with more than 80% of trading volume dominated by tokenized real estate and the rest in other digital security tokens. This is often due to the high barriers to entry for foreign investors. MUFG Bank acquired Osaka Skyscraper for $681M and plans to offer tokenized real estate for its retail and institutional clients. GATES, a leading Japanese real estate investment firm, has also announced a strategic partnership with Oasys to launch $75M of regulatory-compliant, Prime Tokyo real estate on the Oasys blockchain. While real estate transactions are typically marked by illiquidity and large transaction size, the maturity of blockchain transactions has made fractional ownership and seamless transactions possible. Realizing the forecasted $4T size by 2035 will be driven by clearer regulation and improved investor literacy on the legal treatment and benefits of tokenized real estate through both direct and indirect real estate exposure(SPV).

Other notable RWA developments:

HashKey Group made a strategic investment in Asseto to accelerate RWA adoption.

eToro plans to tokenize its stock on Ethereum.

Ondo Finance acquired Oasis Pro to expand regulatory compliant tokenized asset offerings.

Ondo Finance and Pantera plans to invest $250M into tokenized RWA.

BNY Mellon and Goldman Sachs announced a partnership to tokenize select money market funds.

Ondo Finance’s USDY launched on Sei Network.

Securitize takes Hamilton Lane credit fund multichain to Ethereum and Optimism through Wormhole’s multichain solution.

Amber International became the first Asia-based company to tokenize its shares via xStocks on Solana.

Nasdaq-listed firm, Biosiq, arranges a $1.1B financing to tokenize commodities market after merger with Streamex.

JP Morgan Chase and Coinbase partners to allow Chase accounts to be directly linked to Coinbase. Chase Sapphire cardholders also can redeem reward points for USDC on Base.

Avalanche announced that it will be deploying $250M of the Janus Henderson JAAA strategy via Grove.

DePIN

In July 2025, decentralized physical infrastructure networks (DePIN) witnessed a notable surge in adoption. Sector-wide token capitalization climbed past $20 billion, according to CoinGecko, underscoring the narrative’s growing investor appeal. Major categories within DePIN such as Storage, IoT and VPN saw positive token performance, recording gains of 9.52%, 18.41%, 15.43% respectively. Below we will highlight some notable developments of DePIN projects:

Storage:

The Filecoin team has announced that more than 1500+ GPUs have been onboarded to serve AI/ML tasks on io.net, marking another synergistic partnership in the industry. To elevate user experience, Filecoin also teased an upcoming launch of Filecoin CDN which will enable fast PDP data retrievals via a single URL and adopt a usage based pricing mechanism.

Decentralized AI training platform, FLock.io, announced that it will build on Walrus Protocol as its core data layer, leveraging its data storage, availability, programmability and access controls.

IoT:

Peaq reached a new milestone with more than 5M+ onchain identity and machines.

IoTeX launched the Ecosystem Bounty Program.

U Power partnered with IoTeX for corporate bond tokenization and AI-driven DEPIN adoption.

Auki Network announced their integration with Peaq Network with a potential enterprise client.

VPN:

Demand for VPN in the UK spiked 6000% after regulators began enforcing the Online Safety Act which requires age verification for restricted adult content. This led to a sharp increase in NYM token price, underscoring the need for privacy.

Wireless Network:

Helium, the world’s largest decentralized wireless network, has introduced Helium Plus, a service that lets enterprises and venues deliver mobile connectivity by leveraging their existing Wi-Fi infrastructure. With more than 100,000 active hotspots, the network is becoming a crucial infrastructure player for incumbents. As of July 2025, it supports 7 carriers, powers internet connectivity for more than 1M people daily, and has received more than 352,000 Helium mobile subscribers. Demonstrating sustainable real world demand, the project is on track to breach $5M annual revenue this year.

Mapping:

Hivemapper, the leader in decentralized mapping, has partnered with Volkswagen Group’s self-driving unit, ADMT, to leverage Bee Maps as the real-time validation layer.

That’s a wrap for July!