HashKey Capital Monthly Insights Report: August 2025

HASHKEY CAPITAL

Reading Time: 24.57Min

HASHKEY CAPITAL

Reading Time: 24.57Min

Key Takeaways

The crypto market briefly touched $4.19T capitalization in mid-August as Bitcoin crossed $124K and Ethereum nearly hit $5K. Despite retracement from profit-taking, markets remained resilient, supported by dovish Fed signals and pro-crypto policy appointments

Ethereum outshines Bitcoin in August with ETH/BTC ratio at its highest level since August 2024, led by institutional adoption. Solana passed its Alpenglow consensus upgrade, promising faster finality (12s → 150ms) and lower validator costs.

Ethereum DeFi TVL hit $126.3B, while DEX volumes reached an all-time high of $140.4B (+62% MoM).

Stablecoin supply grew to $283.8B, with adjusted volume hitting $3T (+15% MoM).

AI innovation advanced with new models (e.g., Nous Hermes 4, Grass ClipTagger-12B) and frameworks like ERC-8004 fueling the onchain agent economy.

RWAs gained traction: tokenized funds on Centrifuge exceeded $1B TVL, and commodity tokens like XAUt and XAUm are being integrated into lending markets.

Overall Crypto Market Performance

August saw high volatility in the crypto market, driven by shifting macro sentiments, regulatory moves, and an increasingly frothy crypto market. In mid-August, total cryptocurrency market capitalization briefly touched $4.19 trillion as Bitcoin exceeded $124,000 and Ethereum set a record at $4,957, before retracing on broad profit-taking. However, markets remained resilient with total market capitalization staying relatively unchanged from July. Fed Chair Jerome Powell has signalled a more dovish stance during his Jackson Hole speech, and the nomination of Stephan Miran, widely known to be pro-crypto and a critic of the Fed, to become a voting member of the board in September Fed meeting are catalysts mitigating wider market drawdown.

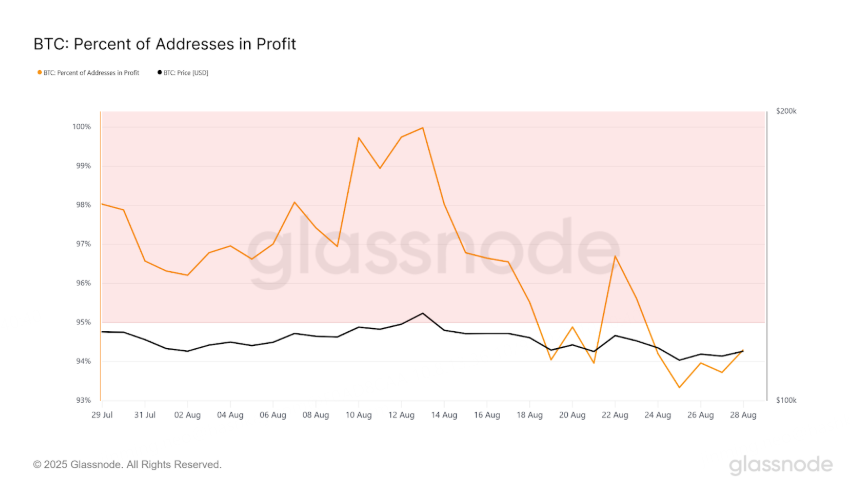

Near term, the market shows signs of buyer exhaustion: Bitcoin spot ETFs posted $749.2 million in net outflows, while Ethereum spot ETFs recorded $3.87 billion in net inflows — their fourth consecutive month — though below July’s $5.4 billion. With a record number of Ethereum addresses in profit ~98%, and ~94% of Bitcoin addresses in profit, upside remains limited with downside more likely in the face of profit taking and potential macroeconomic headwinds. With the markets now pricing in a 85% chance of a rate cut in September, all eyes will be on the economic guidance from the Fed as well as institutional appetite from ETFs and treasury companies.

Regulatory developments were significant across major markets. In China, regulators are reportedly reviewing a yuan-backed stablecoin roadmap that sets out core regulatory oversight and risk-management frameworks — a sharp break from their earlier stance — with further details expected in the coming weeks. In Hong Kong, the fiat-referenced Stablecoin Ordinance formally came into force on Aug 1, opening the HKMA’s licensing window (with transitional arrangements for existing issuers). In South Korea, regulators are reportedly planning to launch a won-backed stablecoin framework (100%-reserve model) in October, as the country’s top banks met with executives from Tether and Circle. Japan’s FSA moved to approve the first yen-backed stablecoin by JPYC in the coming months, marking the first domestically issued JPY stablecoin. In the U.S., Donald Trump also issued a White House executive order directing the Labor Department to review existing guidance with respect to allocation of 401(k) funds into alternative assets, including crypto, a clear policy tailwind. Across Europe, the EBA issued its technical standards on the prudential treatment of banks’ crypto-asset exposures.

Bitcoin

In August, Bitcoin recorded a MoM loss of 6.5%. Policy tailwinds and strong earnings from technology companies have recently fueled Bitcoin to its record highs exceeding $124K in mid-August. However, Bitcoin’s ascent has failed to sustain due to significant profit-taking activities as well as a lack of actionable catalysts. Bitcoin ETFs recorded a monthly net outflows of $749.2M, while Bitcoin treasuries companies have slowed down in their deployment. Strategy, the largest Bitcoin treasury company, purchased $426M of Bitcoin in August, paling in comparison to its July’s purchase of $3.6B. Metaplanet purchased $219.74M in August which is also lower than its July’s purchase of $424.8M. Nonetheless, direct exposure to Bitcoin via mining, publicly-listed and private Bitcoin treasuries have closed the gap with BTC ETFs holdings, underscoring the maturation of regulatory frameworks and infrastructure that allow more direct participation in Bitcoin accumulation.

Mining Updates

In August, Bitcoin mining difficulty increased from 127.6T to 129.7T as hashrate increased from 905 EH/s to 980 EH/s. Hashrate increases can be attributed to new capacity being energized and rigs being redeployed with a few notable developments in August:

Bitdeer increased its self-mining hashrate by 35% to 22.3 EH/s on the continued deployment of its SEALMINERs. 159 MW energized capacity in Bhutan and Norway.

Cipher Mining’s Black Pearl Phase 1 saw the first 150 MW of the 300 MW site being energized and hashing.

Marathon Digital also increased its hashrate going into August with 58.9 EH/s.

Canaan Inc to redeploy 0.5 EH/s after earlier termination agreements with miners.

CleanSpark and IREN both achieved 50 EH/s in hashing power.

Lightning Network

Lightning Network saw increased adoption in August as both lightning channels and capacity increased. In fact, large players are now entering the scene, resulting in smaller, less competitive players being weeded out and a consolidation in channel liquidity. Lightning channels increased from 41,081 to 41,575 while capacity grew modestly from 3,721 to 3,924.

Other notable developments:

SoFi partnered with Lightspark to enable cross-border payments via Lightning Network and LightSpark’s Universal Money Address, becoming the first U.S bank to do so. This partnership opens access to 11.7M active users of SoFi to Lightning-based payments.

Tether also announced the launch of USDT on RGB protocol, enabling native stablecoin transfers on the Lightning Network.

BTCFi

While Bitcoin onchain activity has remained subdued, its adoption has risen in other chains looking to unlock yields for Bitcoin, leverage the highest level of Bitcoin security, and boost token utility within the broader digital asset ecosystem. Morpho, a leading DeFi lending protocol, has already originated more than $1B in Bitcoin-secured loans with close to $2B in collateral. Demand for Bitcoin-native security has grown in August as Babylon saw staked Bitcoin swell from 44,065 to 56,649.

Notable developments in BTCFi

Bitlayer launched YBTC, allowing users to unlock Bitcoin’s DeFi utility in various networks like Avalanche, Solana and Sui.

Lending protocols like Zest and Granite, BitcoinFi protocols on Stacks, also saw growth in activity driven by increasing utility of sBTC as a liquid collateral asset.

Babylon announced trustless vault BitVM3.

Listed company Metalpha is deploying Bitcoin on Solana via Zeus Network-based Apollo Portal, allowing idle Bitcoin to earn yields BTCFi dApps on Zeus. The network has also witnessed a good month as locked Bitcoin grew from 235.45 BTC to 427.12 BTC, representing a 81% MoM growth.

Ethereum

Ethereum had an outstanding August as it broke its November 2021 record and crossed above $4,900 on August 25, thanks to a confluence of positive factors. Although down from its all time highs after profit-taking activities, ETH hovered around $4,750 by month end, recording a gain of 17.7% MoM. The ETH/BTC ratio also increased to its highest level since August 2024, reaching 0.041 as its performance eclipsed Bitcoin. Key drivers included: Fed dovish signals boosting risk appetite, massive institutional demand via ETH ETFs and treasury companies. August marked the second time that ETH ETFs have exceeded BTC ETFs in net inflows, with ETH ETFs bringing in $3.87B while Bitcoin ETFs broke its 4 months ETF gains with net outflows of $749.2M. From ~1.6M of Ethereum holdings at the end of July, Ethereum treasury companies have more than doubled their total holdings to 3.24M. With strong ETFs inflows and corporate ETH accumulation, the ripple effects continued across the ecosystem.

Onchain activity saw an uptick as monthly active addresses rose from 8.5M to 9.3M, while monthly transaction volume increased from 46.7M to 50.2M. Daily transactions on Ethereum hit ~1.8M on Aug 5 — the highest in several years. With average transaction fees less than $1, stablecoin transactions grew in August. Adjusted transaction volume hit $908.2B, soaring by 22.37% MoM, driven by more than 3.1M monthly stablecoin addresses.

DeFi TVL on Ethereum ended August around $126.32B, up from $115.39B in July although this can be partially attributed to gains in Ethereum’s price. DEX volumes, however, reached all-time highs and lending activity continued to see strong momentum.

Liquid Staking / Restaking Updates

While liquid staking and restaking protocols have had a good month in July, activity seemed to have cooled down as TVL across platforms like Ether.fi, EigenCloud, Renzo, saw declines in TVL in ETH terms. This coincided with a surge in validator exits 595,894 to 981,762, representing more than 60% jump, underscoring a surge in profit taking amid Ethereum’s all-time highs.

Innovations, campaigns, and institutional adoption continue nonetheless with some notable developments in August:

Ether.Fi “Summer Mint” incentive campaign ran through the month of August, distributing 500,000 ETHFI across vault deposits/spend. Although restaked Ethereum on the platform declined in August, these incentive campaigns helped maintain Ether.fi’s position as the leading liquid restaking platform.

Renzo introduced ezAuctions, a reward mechanism that enables reward tokens to be converted into ETH and auto-compounded back into ezETH for seamless yield distribution.

Institutional adoption of liquid staked ETH continues to advance as Galaxy launched GK8, allowing custody for stETH. Caladan now also offers stETH as a collateral asset across its options and structured product desk.

DEX

DEX volumes on Ethereum soared to its highest level on record with $140.4B in monthly DEX volumes, driving a 62% MoM gain in liquidity.

Uniswap continues to dominate the DEX landscape as monthly DEX volume grew by more than 78% MoM to $78.2B. Fluid DEX also recorded the highest DEX volume since launch and introduced Fluid DEX Lite which offers gas-optimized swaps at ~10K gas per swap. Starting off with a USDC-USDT pool and a $5M credit line, Fluid DEX Lite has integrated with Velora Dex and Kyber Network, generating $215.69M in August. Ekubo, the third largest DEX, also saw its volume doubled. Ekubo has passed a proposal to incentivize liquidity on Ethereum across various liquidity pairs and MEV-resistant pools starting 3 September for a period of 3 months, which serves as a key catalyst for the DEX in capturing more volumes on Ethereum for the rest of the year. Despite volumes surging to all-time highs led by increasing network usage, fees generated on Ethereum remained low at $71.9M, an unsurprising outcome after Dencun, Pectra Upgrades, and increased block gas limit which drove swarms of users to L2s while also lowering gas fees on Ethereum.

Lending Activity

TVL from lending protocols on Ethereum grew $45.9B to $51.7B, representing a 12.9% MoM growth. This growth is driven by more support for various asset types as collateral, attractive yields and leveraged strategy surrounding USDe. Morpho deepened RWA utility — Centrifuge brought its deRWA to EVM with initial support for using deJAAA, a freely transferable version of the Janus Henderson Anemoy AAA CLO Fund, as collateral on Morpho. Already, the platform boosts support for various RWA tokens to be used as collateral for borrowing.

Aave’s TVL acceleration was led by Ethena’s liquid-leverage program (50% USDe + 50% sUSDe looping strategy on Aave) underscored by attractive yields in sUSDe, and Pendle PT USDe markets that funneled fresh collateral and borrowing demand into Aave. Additionally, Aave has also approved a proposal to accept tokenized gold, XAUt, to be used as collateral in its Ethereum lending market.

Below, we look at leading lending protocols’ TVL growth on Ethereum in August.

L2 Networks

In August, the ratio of monthly active users on L2/L1 was 3.78, down from 4.77 in July. With gas fees staying consistently low, activity has rotated back to mainnet with L2/L1 transaction count similarly reflecting a decline from 15.3x to 13.69x. What we can conclude from this is that consumers are rather price insensitive once gas fees are low, and having substantially lower fees is no longer the main appeal in attracting/retaining users. However, the waning activity across L2s is unevenly distributed with some chains seeing increased adoption in August.

Celo

Unlike some chains, Celo’s transaction surge in August 2025 was not primarily fueled by NFT trading or play-to-earn games — it was driven more by payments and DeFi. Stablecoin transfer volume on the network reached its all-time high, reaching $10.4B. Real-world payment apps built on Celo further boosted token transfers. MiniPay, a mobile wallet integrated into Opera’s browser, rapidly expanded its user base and facilitated everyday transactions for millions in Africa. By August 2025, over 8 million MiniPay wallets had been activated. Despite a staggering $10.4B in stablecoin transfer volume, the average transaction size on the network was ~$40, highlighting that many of these users were conducting frequent small-value transactions (e.g. remittances and payments) using Celo’s stablecoins, contributing significantly to the ERC-20 transfer count. DEX volume on Celo also reached new highs, driven by stablecoin DEX platform, Mento, which recorded more than $3.8B in trading volume, doubling its peak seen in April this year. Stables like USDC and cUSD saw significant traction witnessing more than 8x and 5x growth in transaction volume respectively. cUSD, has seen significant usage, with both active addresses and transaction count steadily rising since June 2025. On Celo, lending platform Aave saw an increase in TVL, driven by high utilization and demand on the platform buoyed by an ongoing aCELO incentive campaign that runs through the year. Borrow caps for USDT and CELO were raised in August to meet this demand. Consequently, Aave generated the highest monthly fees since launching on Celo.

Other notable developments:

Upcoming Ice Cream Hard Fork which is expected to implement EigenDA v2 on 10 September.

Stabila Foundation continues to partner with Uniswap, offering up to 70% APY in UNI and CELO rewards for select stablecoin pools.

Arbitrum

A notable highlight in the Arbitrum ecosystem is the launch of USD.AI, a yield-bearing stablecoin backed by AI infrastructure. Within less than 10 days after launch, its $100M deposit cap was filled, underscoring high demand for RWA yields and potential airdrop farming activities. It has also onboarded more than 11,000 users who benefit from an expected APR of 11.64%. DeFi integrations like Pendle and Euler Finance have been early partners and attracted close to $35M in TVL to the platform. Secondary markets like Fluid have also become a central destination for trading. Fluid DEX currently dominates USD.AI trading volume.

Besides, lending activity continues to gain traction with Aave on Arbitrum originating more than $875M loans, the largest of any L2 chains. Morpho officially launched on Arbitrum, leading to a surge in TVL from $3M to ~$36M as an incentivized campaign to distribute up to 135,000 MORPHO as rewards passed governance voting (MIP-114). Top 3 pools on Morpho currently offer yields between 6–13% APY. Coupled with the launch of Arbitrum’s DRIP Season 1 incentive program distributing 20M ARB across the ecosystem, DeFi platforms like Aave, Morpho are among projects that are expected to see accelerated adoption. Overall, onchain activity escalated with active addresses, transaction count and DEX trading volume rising.

Stablecoin traction also achieved new milestones. Transfer volumes climbed to a record $112.2B, driven by all-time highs in both stablecoin daily active users and circulating supply on the network.

Other notable developments:

Arbitrum DAO votes on Nova cost cap removal which will allow the DAO to stop subsidizing fees on Nova. The proposal also includes updating the upgrade executors for more direct upgrade functions and disabling legacy USDT bridge.

DigiFT and CMB International Asset Management launched the world’s 1st HK–Singapore Mutual Recognition Fund onchain deployed on Ethereum, Arbitrum, Solana and Plume Network.

L1 Networks

Solana

A significant milestone for Solana in August is the passing of the Alpenglow proposal. Key impacts of the Alpenglow consensus model which will replace Solana’s Proof of History:

Votes are moved offchain and are replaced by a fixed per-epoch fee of 1.6 SOL, essentially acting as a gateway for validators to participate in validating the network.

Improved decentralization through lower validators’ operating expenses.

Faster block finality from 12s to 150ms.

With Solana already being one of the fastest public blockchains, the Alpenglow consensus protocol serves to unlock greater network efficiency, enabling the network to become more mature in supporting high-throughput consumer applications. This phased rollout is expected to start with the Agora Testnet at the end of the year with mainnet launch anticipated in Q1 2026.

Solana treasury companies continued their accumulation in August. Total Solana held reached 4,291,770, increasing by 25% MoM. DeFi Development Corp, the second largest Solana treasury company, announced its $99M Solana purchase funded by a $125M equity raise. Supported by rising institutional participation, liquid staking solutions continued to expand in August, though performance varied across providers. Binance’s SOL staking grew in Solana-denominated TVL, while Sanctum’s levels were largely unchanged and Jito experienced a decline.

Lending appetite reflected robust demand as Jupiter Lend went live. Since launch, Jupiter Lend reached $1B within 8 days. Its meteoric rise can be attributed to $2M+ incentives, attractive yields for lenders, wide collateral support, and curated looping strategies that generate enhanced yields for users. Beyond incentives, the underlying architecture of Lend, utilizing Fluid’s liquidity and risk engine, allows Lend to offer a relatively higher LTV than competitors and a flexible liquidation engine.

Trading activity has also increased as perp volume reached its highest volume this year with $42.9B in volume. Drift Protocol saw its highest monthly volume since launch, with $16.3B in August led by 0% fees on BTC and ETH trading pairs. FlashTrade saw perp dex volume doubled, crossing $1B after its introduction of degen mode which allows leverage of up to 500x on SOL, BTC, and ETH. As risk sentiment improved, speculative trading activity saw renewed inflows. Pump.fun staged a roaring recovery as more users returned to its platform and trading volume on PumpSwap rebounded from $6.8B in July to $7.4B, pushing its trading volume market share from 42% in July to 67.64%. Tokens graduated from Pump.fun have also overshadowed all other Solana memecoin launchpads, occupying a 48% market share in August. Other memecoin platforms consequently faced declines in active users and trading volumes.

Stablecoin supply on the network grew in August by 6.5% MoM to $12.14B. Global Dollar Network’s USDG market supply rose rapidly, more than doubling its circulation to $328M, overtaking PYUSD, USDY, FDUSD to become the third largest stablecoin on the network. This can be attributed to enterprise adoption with DeFi Development Corp joining the Global Dollar Network ecosystem of enterprise partners. Additionally, Visa and WalletConnect integrations of USDG also contributed to the distribution of USDG to mass users.

While overall stablecoin transaction volume increased alongside an increase in stablecoin circulating supply, the number of active monthly stablecoin users and number of transactions have fallen from July numbers, underscoring the larger trade sizes that took place on the network.

Other notable developments:

Lombard Finance and Bitlayer launched LBTC and YBTC on Solana respectively.

Blupryntco completed a Know-Your-Issuer pilot initiative with Circle and Paypal that aims to tackle counterfeit tokens.

Prediction markets Kalshi, expands to Solana.

Sui

Sui staged a broad ecosystem recovery in August with adoption and network usage recording strong growth. Daily active addresses more than doubled to 1M, consequently leading to a 29.95% MoM growth in monthly transactions, 79.27% MoM increase in DEX trading volumes and 58.73% MoM increase in network fees. With the Passkey signature scheme now supported on Sui, this significantly lowers the barrier to entry into the Sui ecosystem which will help drive future adoption. Perpetual trading volume on Sui doubled in August led by renewed volume on Bluefin. Bluefin, the leading perpetual trading platform, launched Bluefin Pro at the end of July, which allows up to 40x leverage on selected assets and introduces a dual margin engine that supports cross and isolated margin trading. Since launch, perp volume on the platform has more than doubled to $1.5B, taking up 63% of all perpetual volume on Sui. Overall spot DEX activity on Sui softened; Cetus and Bluefin recorded lower monthly volumes, in contrast to Momentum, which saw an uptick in trading volume due to the launch of incentivized pools and partnership with OKX Wallet.

Beyond DeFi adoption, the social landscape on Sui continues to remain vibrant with the leading SocialFi platform, FanTV, seeing higher usage. FanTV launched the AI Video Studio in late July which boosted engagement by offering a more seamless AI-powered creator experience, further blurring the lines between web2 social application and web3 social application. User grew 7.6% MoM to 201.1K and drove monthly transactions to the highest level since inception. Evidently, having user-friendly account management and advanced AI-driven, consumer-centric features that consistently engage creators and consumers on the platform, have differentiated it from other social platforms that see cyclical adoption from niche groups.

Other notable developments:

Wormhole’s Native Token Transfer framework has integrated with Sui Network.

Robinhood listed SUI.

Passkey is now supported on Sui, with Nimora being the first wallet to leverage passkeys.

Zetachain announced Sui support.

TRM Labs now supports Sui Network, helping it to detect illicit activity in the ecosystem.

Matrixdock’s tokenized gold, XAUm, now live on Sui. With Aave allowing Tether Gold, XAUt, to be used as collateral, XAUm launch on Sui could see a similar growth trajectory as tokenized assets are utilized to unlock greater capital efficiency.

AI Sector

Market capitalization for AI and Data projects edged lower in August, contracting by 1.7% MoM to $30.81B. However, innovations advanced with signs of increasing institutional validation. In terms of model development, Prime Intellect released Environment Hub, an open marketplace for developers to share, contribute and reuse environments. Since launch, the platform has already garnered more than 30+ contributors like Prime Intellect, Arcee AI, Hub and more than 100+ environments that allow developers to validate their reinforcement learning gains across environments instead of relying on private evaluations. Demand side remains to be seen, although the sustained launch of high-quality environments will lead to a positive flywheel that also contributes to Prime Intellect developing competitive SOTA models. Grass released its Video Annotation Model, ClipTagger-12B, which helps to annotate objects seen in videos and has been proven to outperform Claude 4 and GPT‑4.1 on annotation metrics like ROUGE and BLEU, while running up to 17x cheaper. The model is trained on over 1B in video dataset and hosted by Inference Net distributed compute infrastructure. Nous Research also announced the launch of Hermes 4 line of models. Although it still underperforms leading open source models like Qwen3 235B, and DeepSeek V3.1, it outperforms in terms of output speed, token pricing and in certain areas like coding and uncensorable responses. Adoption of the model has also gained significant developer mindshare, with more than 4.6K downloads for its Hermes 4–70B model.

On the agent side, Olas launched a Mech Marketplace, enabling users to manage, view and monetize their agents seamlessly. ERC-8004 was also widely discussed nearer the end of the month, with strong community enthusiasm over its potential to unleash verifiable, reputation-based, agent-to-agent interactions onchain. We also wrote about ERC-8004 and its potential impacts across the ecosystem here. Virtuals Protocol announced native support for USDC in Agent Commerce Protocol, enabling a standardized currency for seamless agent transactions.

On the institutional adoption front, August 2025 marked a watershed moment for the institutional adoption of Web3 AI projects, headlined by JP Morgan Asset Management’s landmark $500 million capital commitment to Numerai. This substantial investment in the AI-driven hedge fund sent a clear signal to the market, validating the power of decentralized model contribution and token incentives in enhancing AI performance for sophisticated financial applications. The move is widely seen as a pivotal step, likely to encourage further institutional capital to flow into quality Web3 AI projects that can demonstrate a clear, performance-based edge.

DeFi

Onchain trading picked up in August: DEX activity rose, with average daily DEX volumes up ~18% MoM to $16.7B, and the month finished as the highest DEX month on record. Ethereum DEX volume hit a record ~$140B and regained leadership from Solana to become the chain with the highest DEX volume since March 2025. Key contributors include Pendle which saw its highest DEX volume of $5.1B in August, alongside ~55% MoM increase in TVL. Perps set a new high at ~$649B, led by Hyperliquid generating ~$405B. Over the past few months, EdgeX has rapidly ascended the ranks to claim the second spot among perpetual trading platforms behind Hyperliquid, recording more than $43B in volume and lifting its market share to ~9% from just 1.7% in April. Pendle’s Boros platform which allows users to trade funding rates of BTC and ETH with leverage up to 3x using cross-margin/isolated margin has also attracted significant inflows. Trading volume on Boros reached $395M in the first month of launch. Overall, DEX trading volume recorded its best month, crossing $1T in volume processed.

Lending protocols saw strong growth traction in August, increasing by 11.67% MoM to reach a TVL of $78.09B. Aave TVL grew by 14.82% MoM largely contributed by its partnerships with Ethena via Liquid Leverage and Pendle’s PT tokens. Ethena-related assets reached ~$6.6B, close to 10% of Aave’s TVL, with ~$2B contributed by liquid leverage incentive campaign and the rest in PT tokens. Beyond that, Metamask also introduced Metamask Earn, which now contributed more than $100M+ to Aave, generating yields on users’ stablecoins. Maple Finance has also seen increased adoption of its syrupUSDC which offers ~9% APY. Ecosystem partnerships have also boosted adoption of syrupUSDC. Spark contributed an additional $105M into syrupUSDC, bringing its total contribution to $530M while Jupiter Lend started to accept syrupUSDC as collateral asset, increasing utility for the token.

RWA — Expanding Utility of RWA Tokens

Beyond AUM growth, August underscored how RWA tokens are becoming productive collateral and borrowable assets rather than just “buy-and-hold” yield. On the equity side, platforms like Centrifuge are bringing deRWA tokens into institutional lending/borrowing markets like Aave and Morpho. To date, tokenized RWA funds on Centrifuge have exceeded $1B in TVL, recording a growth of ~60% MoM.

Commodities are joining the loop as well — gold tokens (XAUt on Aave and XAUm on Sui) are being integrated for lending/borrowing and hedging. For institutions, platforms such as Horizon focus on permissioned rails (KYC/AML), NAV/oracle attestations, quality of underlying RWA collateral, and reporting hooks so treasurers can hold, pledge, repo, or borrow against tokenized instruments within policy. Net-net: the RWA stack is shifting from trading to multi-utility assets — collateral, liquidity, and treasury tooling — broadening market demand and deepening integration with DeFi.

Other notable developments:

SBI Holdings, Startale announce RWA tokenized trading platform.

Slovenia becomes the first European Union nation to issue a sovereign digital bond.

Chainlink teams up with NYSE-Parent ICE to bring forex, precious metals data onchain.

BVNK launched Smart Treasury solution, an AI-driven yield and treasury automation tool, to customers of Layer1.

Stablecoins

In August, total circulating stablecoin supply grew by 6.49% MoM to $283.84B and adjusted stablecoin transactions volume reached $3T. Amid low gas fees, stablecoin activity on Ethereum surged with the network now having 53% market share and holding $150B of circulating stablecoin supply. Stablecoin transaction volume on Ethereum also surged to its highest level, processing $1.8T in August across 3.1M active monthly addresses. This growth can be contributed by both an increase in institutional adoption as well as expansion in several notable stablecoins. Large transaction size >$10M on Ethereum was the highest at 19.53K, exceeding Solana, underscoring more institutional participation in the network in August. Further, Ethena’s USDe leaped 50% MoM to a market supply of $12.3B as sUSDe yields climbed from low 2–3% APY to more than 12% APY. Incentivized campaigns and leveraged yield looping strategies via Aave and Pendle have also sustained the adoption flywheel, consequently driving stablecoin growth on the network. Solana also saw significant growth as circulating stablecoin supply on the network advanced 6.14% MoM to $12.14B. With more than 3.7M monthly active users, Solana continues to see healthy stablecoin activity, processing more than 240.2M transactions in August. USDG supply on Solana expanded 77% month-over-month, driven by institutional uptake from DeFi Development Corp, Bullish, and OKX, alongside deeper ecosystem integrations and $200k Kamino incentives. These developments have elevated USDG to become the third-largest stablecoin by circulating supply ($328M), surpassing FDUSD and PYUSD, while its active user base rose 33% month-over-month to 9.1K. USD1 on Solana also saw significant user traction as leading Solana protocols introduced incentive campaigns to grow liquidity.

M&A and venture funding activity around stablecoin payments remained robust. The sector saw its highest monthly funding of $3.6B, across 13 deals. Notable funding include Rain which raised a $58M Series B round to scale its enterprise stablecoin platform. Stablecoin infrastructure provider behind Metamask’s mUSD, M0, has also raised a $40M Series B round. On 7 August, Ripple agreed to acquire Rail, a stablecoin payment platform, for $200M in cash, which is expected to close in Q4 2025.

Regulatory developments have also been positive globally. In South Korea, the FSC is currently working on its Stablecoin Bill which is expected to be submitted to the legislative body in October. Japanese firm, JPYC, said it has received the necessary license and will issue the first yen-pegged stablecoin later this year; backing in bank deposits/JGBs. In Hong Kong, the Stablecoins Ordinance officially came into effect on 1 August. Market reception has been strong, with 77 firms submitting license applications in August. In parallel, Standard Chartered, Animoca Brands, and HKT formed Anchorpoint Financial to apply for a Hong Kong stablecoin issuer license.

Other notable developments:

Circle launched Gateway, enabling a unified USDC balance across chains without the need for manual fund bridging.

Ethena announced that USDtb will soon be live on Aave Horizon.

Anoma announced AnomaPay which will be integrated with Noble to serve as the underlying payment router, offering the efficient, confidential pathways for stablecoin transactions.

Hana Bank, Korea’s third-largest lender, signed a memorandum of understanding (MOU) with Circle.

Ripple partners with SBI to roll out RLUSD stablecoin in Japan by Q1 2026.

RedotPay Launches Instant Fiat-to-Stablecoin Onramps in the UK and European Union.

Tether Backs Bit2Me with Strategic Investment to Expand Regulated Crypto Services Across Europe and Latin America.

That’s a wrap for August!