The Consumer Side of DePin: Opportunities, Challenges, and Emerging Trends

HASHKEY CAPITAL

Reading Time: 15.87Min

HASHKEY CAPITAL

Reading Time: 15.87Min

Key Takeaways

With more than 1000+ DePIN projects to date across various verticals, DePIN represents a fundamental component of the crypto industry, generating $14M+ ARR.

By using blockchain technology and innovative tokenomics, DePIN has shown its mettle in efficiently bootstrapping capital and enabling fairer access to infrastructural networks.

Despite that, lack of retail awareness, regulatory uncertainty, and increasing focus on user experience over cost are some of the impediments that need to be addressed for the sector to scale.

DePIN faces several tailwinds as well such as burgeoning demand from low to middle income economies, improved onboarding process, sector-wide growth of Artificial Intelligence (AI) and Internet of Things (IoT).

Introduction

DePIN, which stands for decentralized physical infrastructure network, remains as a fundamental building block of crypto. Despite having a total market cap of around US$56B as of 3 July, the sector seeks to meaningfully address challenges faced by Web2 infrastructure networks that are currently valued in the trillions. Leveraging on the innovative use of blockchain technology and tokenomics, emerging DePIN projects have the potential to disrupt incumbent players dominating various fields such as Internet of Things, Artificial Intelligence, Wireless Coverage, Energy, Data among others. Currently, there are more than 1000+ DePIN projects, generating about $14M+ in annual recurring revenue (ARR).

To achieve widespread adoption, consumer DePINs which is defined as decentralized networks that provide physical or virtual resources via engaging retail users on the supply and/or demand side, must activate the positive flywheel effect crucial to their adoption. This report aims to provide a comprehensive overview of the DePIN landscape, spotlighting several notable consumer DePIN projects that have made notable strides in adoption. We will then conclude by sharing some of the challenges and opportunities within consumer DePIN.

Overview of the consumer DePIN landscape

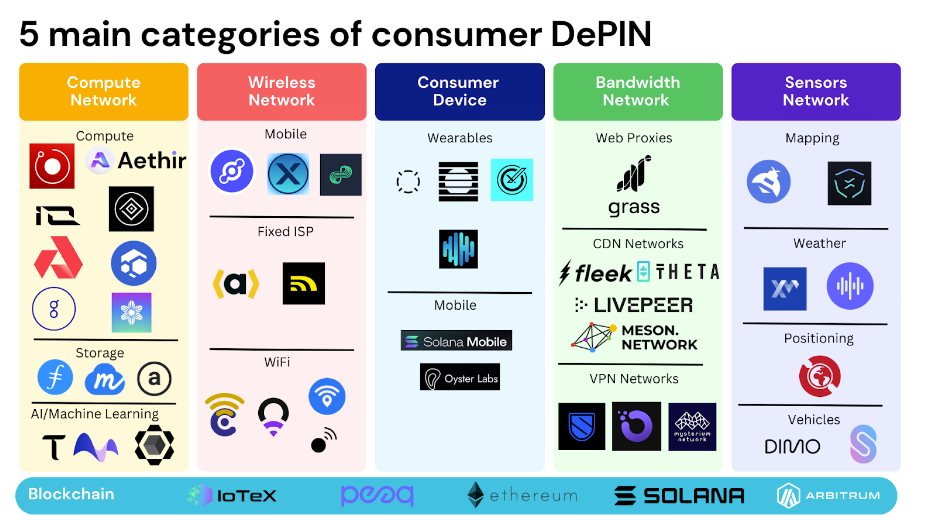

As one of the most durable use cases of blockchain technology that is tightly interwoven with the real world, consumer DePIN landscape has grown to encompass a diverse ecosystem of players all playing a critical role in shaping its future. By leveraging various DePIN infrastructure modules such as blockchain networks, developers can now effortlessly create applications that directly benefit consumers. Consumer DePIN can be broadly classified into five primary categories: Compute, Wireless, Bandwidth, Energy, and Sensors. This categorization highlights the broad potential of consumer DePIN to revolutionize how everyday users interact with and benefit from decentralized technologies, bringing tangible improvements to daily life.

Source: HashKey Capital

DePIN Projects Highlight

In this section, we highlight projects across various categories that have demonstrated significant growth and are instrumental in the adoption of DePIN. *The list of projects listed here are not meant to be exhaustive.

Computing Networks

Off-chain computing networks allow anyone to monetize their computing resources (GPUs, CPUs, FPGA etc.) that are hosted in the cloud or owned by community members. This insatiable demand for compute resources is partly attributed to one area of AI that has seen significant growth, Generative AI. According to Statista, the global market size of generative AI is expected to cross $200B by 2030, at a CAGR of 20.7%. Decentralized computing networks serve to lower costs and barriers to entry for smaller AI labs by aggregating and optimizing unused compute resources. Examples of projects within the compute category include: Aethir, Compute Labs, Render, io.net etc.

Aethir

Aethir operates within the compute segment of DePIN as a GPU-as-a-Service platform. Its platform caters to the increasing demand for compute resources stemming from artificial intelligence, cloud gaming, and virtualized computing. Aethir allows GPU providers to unlock revenue potential from underutilized GPU chips and end users to benefit from high quality, cost effective solutions. By operating on a Proof-of-Rendering mechanism, Aethir ensures that rendering tasks are completed correctly before reward distribution. This is enabled by the checker nodes. Checkers ensure that each task is completed and meets the specifications and standards, contributing to the trust and security of the overall network.

Key Stats on Checker Nodes Sales

Total checker node sold | 74,673 |

Node Operators | 20,584 |

Source: Dune Analytics, data as of 2 July 2024

Compute Labs

Compute Labs is an AI-Fi platform at the intersection of AI compute supply and financial derivatives that aims to democratize investment opportunities into valuable GPU resources through fractional ownerships in the form of NFT issuance known as GNFTs. Investors holding these GNFTs gain direct exposure to yields from compute resources. Compute labs manages all aspects of the operations in its T3 internet data centers, ensuring optimal performance and security. It also leases compute resources to various end users such as centralized and decentralized entities.

Render Network

Render is a decentralized GPU marketplace that connects artists with GPU compute providers built on the Solana network. Node operators with unused GPU compute can contribute their resources and earn $RNDR for processing artists rendering needs. With the use of Render network, 3D rendering can be done in a shorter span of time and at much lower costs compared to centralized services. Render also uses a combination of end-to-end encryption, hashing, virtualization and secure centralized storage to ensure privacy and security. Since its inception, the platform has boarded 5,600 node operators and rendered more than 34.7M frames.

io.net

io.net is a distributed GPU marketplace that provides access to GPU resources without the expensive hardware requirements and infrastructure management. IO.net sources its compute resources from providers such as data miners, crypto miners, individuals and provides them to machine learning engineers. Its core product, IO Cloud, consists of a distributed network of GPUs/CPUs capable of executing Python-based ML code for AI projects. The platform offers 4 core services: Batch inference and model serving, parallel training, parallel hyperparameter tuning, and reinforcement learning. In order to verify that the GPU resource is provided, IO.net operates based on a Proof-of-Timelock mechanism. This mechanism ensures that the devices rented are fully committed to the task at hand during the entire duration and not used by other services or apps.

Key Stats

Total Number of Verified GPUs | 255,206 |

Total Number of Verified CPUs | 61,484 |

Total Compute Hours Served | 925,475 |

Total Network Earnings | $1,094,009 |

Total Worker Earnings | $1,038,942 |

Source: io.net, data as of 3 July 2024

Comparison of AI compute networks

Render | io.net | Aethir | |

Number of GPUs | 5,600 | 253,266 | 43,000+ |

Number of CPUs | 60,710 | NA | |

Source of compute resources | Consumers | Data centers, miners, hardware networks like Filecoin, Render and others | Enterprises, data centers, miners |

Client Base | Artists, large studios and enterprises | AI Labs/Startups | AI Labs, Game Studios |

Use cases | 3D rendering, augmented reality and gaming | AI/ML | Gaming, AI/ML |

Verification layer | No | No | Yes |

Source: Render Foundation, io.net, Aethir, data as of 3 July 2024

Blockchain Networks

Launching a DePIN project from scratch is often not easy as developers need to allocate resources into building out the various modular infrastructures. To aid developers in more effectively allocating resources, several DePIN-native blockchains have emerged offering various modular tools that ease the process of developing DePIN projects. The two notable DePIN-specific blockchains are Peaq and IoTeX.

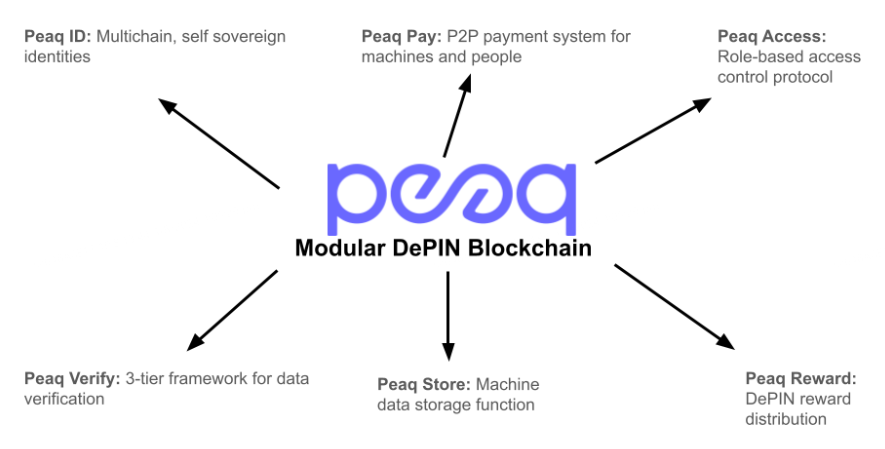

Peaq

Peaq is a L1 blockchain designed for DePIN applications, promising high throughput of up to 10,000 TPS and low transaction cost. Peaq enables seamless interaction with Polkadot, cross chain machine id with Cosmos, Solana, BNB and bridges back to Ethereum. As the hub for numerous high-volume DePIN applications, security of the network is paramount. Peaq has achieved a Nakamoto coefficient above 90, which is testament to the network’s emphasis on security. Peaq also eases the development of DePIN projects with modular blockchain functions. Popular projects building on the network include Silencio, NATIX, ELOOP, Penomo, among others.

Source: HashKey Capital

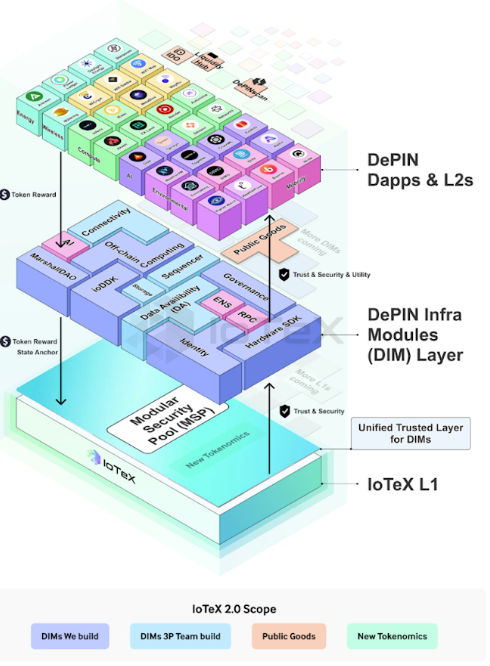

IoTeX

IoTeX is a Layer 1, EVM-compatible, high-performance DePIN blockchain that incorporates and orchestrates key software and hardware building blocks in DePIN to connect the digital and physical worlds. Recently, the team at IoTeX announced IoTeX 2.0 which serves as a guiding post for IoTeX to become an inclusive, open DePIN infrastructure. IoTeX 2.0 architecture is underpinned by several new/revamped features such as improved tokenomics, Modular Security Pool, W3bstream, ioDDK, ioConnect and ioID. Through providing various self-developed/third party infrastructural modules that can be customized to suit different stage and project requirements, developers are able to seamlessly deploy DePIN projects on IoTeX.

IoTeX 2.0 Architecture.

Source: IoTeX Whitepaper 2.0

Comparison between Peaq and IoTeX

Peaq | IoTeX | |

TPS | 10,000 | 1,000 |

Number of connected devices | 635,000+ | 2,400,000+ |

Number of ecosystem partners | 30+ | 215 |

Source: Peaq, Chainspect, IoTeX, data as of 3 July 2024

Wireless Connectivity Networks

Decentralized connectivity networks allow users to provide and access wireless network services without having to rely on centralized telecom operators. Key catalysts for the overall growth in the DeWi space are the advancement in wireless technology such as 5G, widespread adoption of IoT devices, and cost effectiveness of DeWi solutions. With global internet penetration rate at 67% in 2024, decentralized wireless providers strive to fill this gap by offering low-cost, secure, alternatives. Examples of projects operating a decentralized wireless network include: Helium, Nodle, XNET, WiFi Dabba, Wicrypt, WiFi Map etc.

Helium

Helium is a decentralized wireless network built on the Solana blockchain. As the largest decentralized wireless network, its utility has been critical in powering the IoT economy across categories such as smart agriculture, smart water monitoring, smart cities, environment monitoring, logistics and supply chain among others. Helium network is powered by 2 key subnetworks: Helium IoT and Helium Mobile.

Helium IoT hotspots gather data from IoT devices and relay it to Helium LoRaWAN network servers. Subsequently, this data is transferred to a specific device application server. Helium Mobile, a mobile carrier created by Nova Labs, aims to provide a cost efficient 5G network for users around the world through a dynamic coverage model.

Key IoT Stats

Active Hotspots | 371,746 |

Cumulative onboarding fees paid by active hotspots | $16,490,740 |

Source: Helium explorer, data as of 3 July 2024

Key Helium Mobile Stats

Number of Active Hotspots | 17,984 |

Cumulative onboarding fees paid by active hotspots | $427,280 |

Total number of Helium mobile subscribers | 97,461 |

Source: Dune analytics, Helium explorer, data as of 3 July 2024

Nodle

Nodle is a decentralized wireless network built on zkSync. As a smartphone-based network, Nodle app uses Bluetooth Low energy (BLE) to provide connectivity to BLE-enabled things and power critical applications for authenticating media content, locating assets or proving location. Under its belt, Nodle has released a family of authentication tools such as ContentSign SDK, ConnectX, Nodle SDK, Nodle Hotspot, Click app, and Nodle app. Users that run the mobile app by turning on their bluetooth and location data will earn a share of the $NODL rewards. Nodle consumers are people or entities that interact with the network by paying a fee in return for a service such as gaining data insights or proximal connectivity etc.

Key Stats

Monthly Active Nodes | 492,457 |

Monthly Active H3 tiles | 9,302,311 |

Countries covered | 186 |

Average nodes per active tile | 1706 |

Source: Nodle explorer, data as of 3 July 2024

Bandwidth Network

Bandwidth networks are projects that focus on the distribution and efficient use of internet data capacity to cater to various use cases such as web scraping, streaming, online gaming, and content delivery networks. Examples of projects include Grass Network, Meson, Sentinel, Livepeer among others.

Grass Network

Grass is a L2 data rollup on Solana that enables users to sell their spare internet bandwidth in their devices and earn rewards for contributing to the development of better AI models. Whenever a Grass node scrapes data from the web, it returns an encrypted response of all the data requested by the client. This data is used for AI training or inference with a proven lineage that is established back to the Grass node that provided the data. This establishes a fairer and more equitable distribution of rewards, transferring the power back into the hands of the contributors.

Sensor Networks

The Internet of Things market is expected to seize US$947.5B in global revenue in 2024, growing at a CAGR of 10.4% from 2024 to 2029. Advancing this growth is the rapid demand for IoT sensors within the industrial, consumer and automotive industries to distill data-driven, actionable insights. Examples of projects in the sensor network include Hivemapper, Dimo, WeatherXM, Geodnet, NATIX, Silencio among others.

Hivemapper

Launched in November 2022, Hivemapper is a decentralized network for street-level mapping and imaging built on the Solana network. Drivers can buy Hivemapper’s dash cam, Bee, to collect high-quality, street level imagery while earning rewards in the form of HONEY. Aside from the hardware component of Bee, it also has a Map AI software component that accurately detects, classifies and positions objects down to 50cm. Alternatively, participants can play AI Trainer games on mobile or desktop to finetune the map and improve machine learning models. HONEY tokens are burnt to access map data which is used to support products and services of enterprises and developers, ensuring a positive flywheel relationship between the map consumers and map contributors. To date, it has achieved several milestones such as mapping 21% of the world’s map in 19 months.

Key Stats

Total km mapped | 257M |

Unique km mapped | 13.72M |

Number of contributors | 145,905 |

Regions covered | 2,720 |

Source: Hivemapper explorer, data as of 30 June 2024

DIMO

Dimo is a decentralized vehicle platform built on the Polygon blockchain. On the Dimo network, drivers can use the Dimo hardware to connect their cars to unlock $DIMO rewards for contributing vehicle data to the network. This data is used by data subscribers such as application developers who have to pay in $DIMO to tap into drivers data.

Key Stats

Number of vehicles id | 94,522 |

Total unique car models covered | 1,665 |

Number of vehicles id holders | 33,468 |

Total miles traveled | 510,206,660 |

Source: Dune analytics, data as of 1 July 2024

WeatherXM

WeatherXM is a community-powered weather network built on Arbitrum, rewarding users for providing hyper-local weather data to web2 enterprises and smart contracts onchain. Its core product being the weather station hardware collects hyper-local environmental data, generates a cryptographic proof of the data collected and stores the data on decentralized storage platform, Filecoin. Users who deploy weather stations and contribute to the network are able to earn its native governance and utility token, $WXM.

Key Stats

Weather Station Days (30D) | 147.8K |

Total Weather Station Days | 2.1M |

Total Weather Stations | 7,795 |

Activity Rate of Weather Stations | 64% |

Source: Weatherxm explorer, data as of 1 July 2024

Geodnet

Geodnet is a network that utilizes cryptocurrency to bootstrap a network of Global Navigation Satellite Systems (GNSS) reference stations to improve the accuracy of location data. GEODNET gathers real-time geospatial data using innovative rooftop Space Weather stations and blockchain technology, creating a secure and resilient network. This network provides reliable data for sectors like Agriculture, Transportation, Finance, Autonomy, AR/VR, and the Metaverse. Compared to standard GPS which is usually off by around two meters, Geodnet is able to provide accuracy of within 1 - 2 cm with repositioning done every second. Its customers come from diverse industries ranging from agriculture, drones, construction and IoT that have started to rely on Real Time Kinematics (RTK) instead of GPS.

Key Stats

Number of miners | 7611 |

% of active miners | 83.3% |

Total number of reference stations | >7,000 |

Source: Geodnet explorer, data as of 8 July 2024

Comparison of Sensor Networks

Hivemapper | DIMO | WeatherXM | Geodnet | |

Data Type | Traffic Conditions | Vehicle Status | Weather Status | Location Correction |

Data Supply | Dash Cams connected to vehicles, mobile applications | AutoPi and Macaron hardwares connected to vehicles | Deployable weather stations | GNSS base stations |

Location sensitive | Yes | Yes | Yes | Yes |

Data Demand | Autonomous vehicles, ADAS | Car applications | Agricultural sector, climate change efforts | Agricultural sector, drones, construction, IoT |

Hardware providers | Hivemapper Inc | AutoPi Hashdog | ExMachina (EXM) | Hyfix, Eugeo, TechnostoreX, Rock Robotic, EASYNAV, Mapping Network |

Device Costs | $489, $589 | $136, $478 | $400, $900 | $695 |

Consumer Wearables

Underpinning the rising adoption of IoT is a specific sector known as consumer wearables. Consumer wearables refers to daily accessories/gadgets worn by retail consumers which when integrated into the web3 ecosystem unlock monetization opportunities for users over their personal data. Some of the projects operating in this field include GM Network, Cudis, WatchX among others.

GM Network

GM Network is the first consumer AIOT network, supporting the growth of AI and Internet of Things. Built as a restaked rollup on Eigenlayer, powered by Altlayer, GM Network is supported by 3 core layers namely: asset layer, data layer and user layer. The asset layer, GM Network, is a Layer 2 rollup on Eigenlayer. Data layer is made of modular components like GM ID and GM OS. User layer consists of dApps such as consumer focused AI applications that tap into the datasets derived from consumer wearables. To foster the growth of IoT devices on its platform, GM Studio, incubator of GM Network, provides technical expertise and support to AI-powered consumer IoT products. The first product incubated by GM Studio, Yozoo, is a smart wearable device that integrates AI with health, offering personalized, science-based health management.

Cudis

Cudis is a consumer wellness, AI-enabled ring on the Solana network. Supplemented by an application, it features chatGPT-powered AI coach that delivers tailored advice based on biometric data collected from the ring. Users can also engage with the app across various domains such as emotional, spiritual, physical etc to earn rewards.

Consumer DePIN Hardware Partners

Seeed Studio

Seeed studio is an IoT technology company that specializes in hardware research, production and sales for edge computing, network communication and smart sensing applications. Seeed studio partners with various DePIN projects such as Helium Network to advance the adoption of digital transformation. Through its platform products, Seeed Studio has covered 100+ countries with 200k+ end users.

RAKwireless

RAKwireless is an IoT technology company that produces and deploys IoT solutions, leveraging on its deep expertise in GPS, LoRa, LPWAN, LoraWAN and Cellular technologies. RAKwireless provides an end to end solution that makes the deployment of IoT seamless with products, softwares and services that serve IoT developers and IoT deployers.

Challenges and Opportunities

Challenges

DePIN projects struggle to sustain demand due to the proliferation of projects competing in the same vertical as well as competition from incumbent Web2 peers which can potentially dilute market share of already small DePIN projects. As such, it would be beneficial for projects to diversify and create different demand channels extending beyond Web3. The fairly nascent DePIN sector also makes it arduous to generate demand from retail consumers and Web2 enterprises who lack the awareness and trust in the reliability of the sector.

One of the core value propositions of DePIN is the ability to reduce monopolies on industries, hence achieving price competitiveness. However, this can be a double-edge sword as intense competition in fees often leads to low switching costs and retention rate. The removal of exorbitant fees has also shifted the focus towards user experience as a key differentiating factor among projects.

DePIN projects face challenges with upfront capital costs and supply chain issues, which can hinder their ability to quickly reach the necessary threshold scale to effectively serve a market.

Regulatory roadblocks. It helps for projects to be cognizant of the regulatory environment especially for sensitive industries such as telecommunications, cloud services etc.

Opportunities

Low to middle income countries serve to be key catalysts for DePIN growth due to the rising demand for price competitive solutions and fair access to key infrastructural needs.

Easy deployment through node sales, one of the most popular bootstrapping mechanisms now, has also allowed users to quickly participate in the ecosystem and for projects to lock in a long term community, while raising additional funds for project development.

Some areas such as AI see greater growth riding on increasing computational demands of large language models. Having blockchain to unify idle resources allows for efficient resource utilization and monetization, while addressing potential demand-supply mismatch.

Internet of Things is expected to exceed US$945B by the end of the year and grow at a CAGR of 10.5% from 2024-2029 according to a report by Statista. DePIN has the potential to capture a share of the pie from traditional players by creating strong user-owned economies where privacy and data control lie in the hands of users.

HashKey Capital is committed to investing in high-potential categories within the DePIN landscape to drive its future. If your project is focused on these areas, we invite you to connect with us to explore potential collaboration opportunities!

References

https://renderfoundation.com/whitepaper

https://stats.renderfoundation.com

https://aethir.com/

https://dune.com/sohwak_archive/aethir

https://docs.peaq.network/docs/quick-start/what-is-peaq/

https://dune.com/rawrmaan/helium-mobile

https://explorer.helium.com/stats

https://www.getgrass.io/blog/grass-the-first-ever-layer-2-data-rollup

https://wynd-network.gitbook.io/grass-docs/architecture/overview

https://bee.hivemapper.com/

https://docs.dimo.zone/overview

https://geodnet.com/

https://dune.com/geodnet_console/geod-console

https://www.gpsworld.com/geodnet-enters-distribution-and-oem-agreements/

https://docs.gmnetwork.ai/docs

https://www.chainalysis.com/blog/2023-global-crypto-adoption-index/#top20

https://www.statista.com/outlook/tmo/internet-of-things/worldwide

https://www-statista-com.libproxy.smu.edu.sg/outlook/tmo/internet-of-things/worldwide#revenue

https://www-statista-com.libproxy.smu.edu.sg/forecasts/1449838/generative-ai-market-size-worldwide

https://www-statista-com.libproxy.smu.edu.sg/outlook/tmo/artificial-intelligence/worldwide

DISCLAIMER

This material is for general information only, and does not constitute, nor should it be interpreted as, any form of research output, professional advice, solicitation, offer, recommendation, or trading strategy. No guarantee, representation, warranty or undertaking, express or implied, is made as to the fairness, accuracy, timeliness, completeness or correctness of any general financial and market information, analysis, and/or opinions provided on this report, and no liability or responsibility is accepted by HashKey Capital in relation to the use of or reliance on any such information. Any information on this report subject to change without notice. This report has not been reviewed by the Securities and Futures Commission of Hong Kong, the Monetary Authority of Singapore or any regulatory authority in Hong Kong or Singapore.

Please be aware that digital assets, including cryptocurrencies, are highly volatile and subject to market risks. The value of digital assets can fluctuate significantly, and there is no guarantee of profit or preservation of capital. You should carefully consider your own risk tolerance and financial situation before making any decision.

Distribution of this report may be restricted in certain jurisdictions. This material does not constitute the distribution of any information or the making of any offer or solicitation by in any jurisdiction in which such action is not authorised or to any person to whom it is unlawful to distribute such a report.